Question: Remaining Time: 1 hour, 15 minutes, 56 seconds. * Question Completion Status: d. common stock QUESTION 7 Your client has been offered a money market

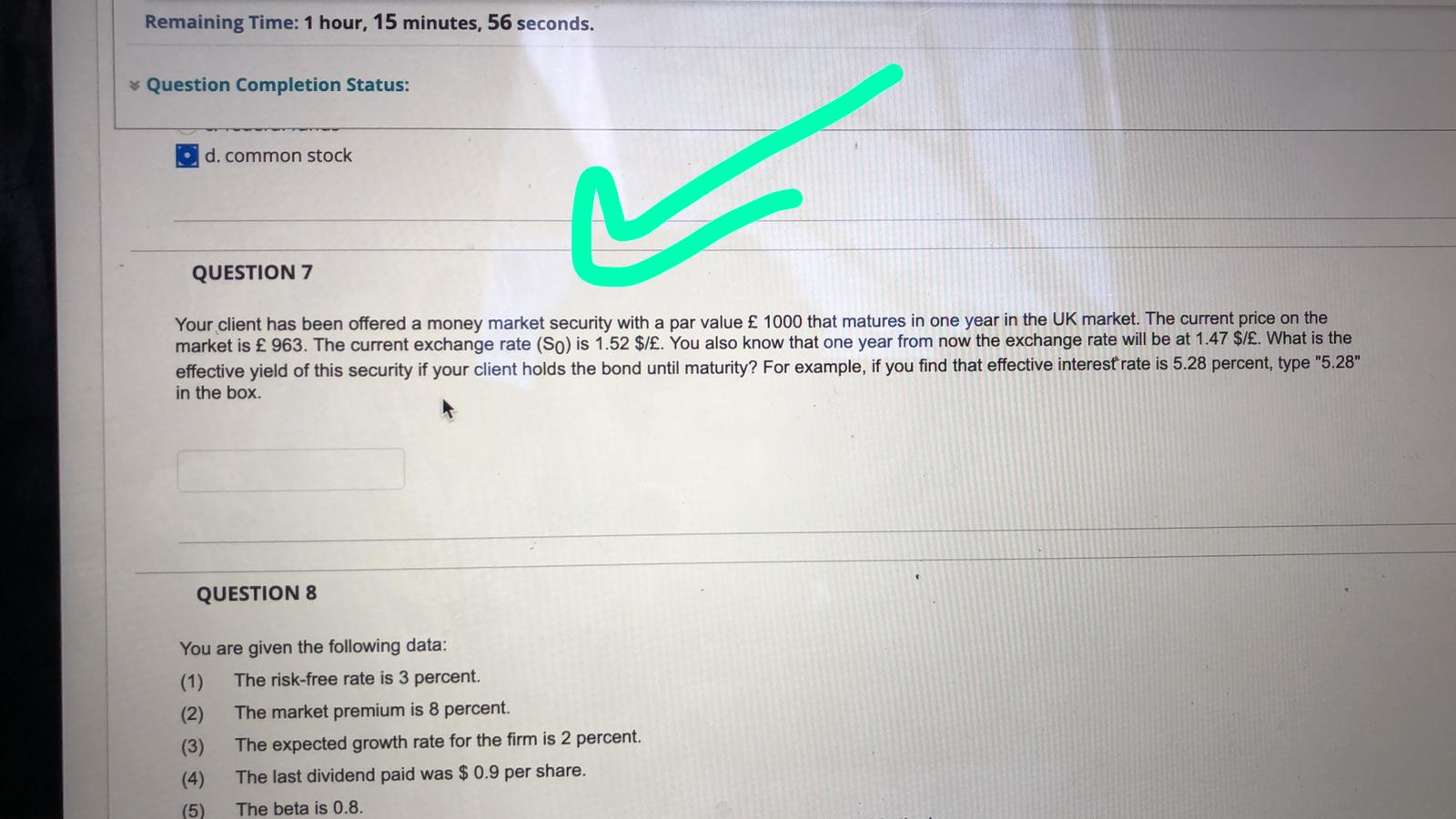

Remaining Time: 1 hour, 15 minutes, 56 seconds. * Question Completion Status: d. common stock QUESTION 7 Your client has been offered a money market security with a par value 1000 that matures in one year in the UK market. The current price on the market is 963. The current exchange rate (So) is 1.52 $/. You also know that one year from now the exchange rate will be at 1.47 $/. What is the effective yield of this security if your client holds the bond until maturity? For example, if you find that effective interest rate is 5.28 percent, type "5.28" in the box. QUESTION 8 You are given the following data: (1) The risk-free rate is 3 percent. (2) The market premium is 8 percent. (3) The expected growth rate for the firm is 2 percent. (4) The last dividend paid was $ 0.9 per share. (5) The beta is 0.8

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts