Question: Remaining Time: 1 hour, 39 minutes, 12 seconds. Question Completion Status: Smathers Corp. stock has a beta of 1.21. The market risk premium is 720

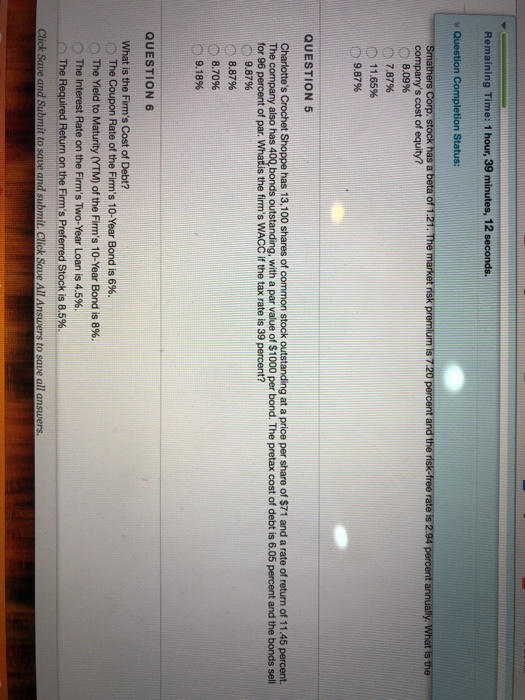

Remaining Time: 1 hour, 39 minutes, 12 seconds. Question Completion Status: Smathers Corp. stock has a beta of 1.21. The market risk premium is 720 percent and the risk-free rate is 2.94 percent annually. What is the company's cost of equity? 8.09% 7.87% 11.65% 9.87% QUESTION 5 Charlotte's Crochet Shoppe has 13,100 shares of common stock outstanding at a price per share of $71 and a rate of return of 11.45 percent. The company also has 400 bonds outstanding, with a par value of $1000 per bond. The pretax cost of debt is 6.05 percent and the bonds sell for 96 percent of par. What is the firm's WACC if the tax rate is 39 percent? 9.87% 8.87% 8.70% 9.18% QUESTION 6 What is the Firm's Cost of Debt? The Coupon Rate of the Firm's 10-Year Bond is 6%. The Yield to Maturity (YTM) of the Firm's 10-Year Bond is 8%. The Interest Rate on the Firm's Two-Year Loan is 4.5%. The Required Return on the Firm's Preferred Stock is 8.5%. Click Save and Submit to save and submit. Click Save All Answers to save all answers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts