Question: Remaining Time: 57 minutes, 42 seconds. Question Completion Status: 1 2 3 6 7 8 10 11 12 13 14 Question 14 20 points Save

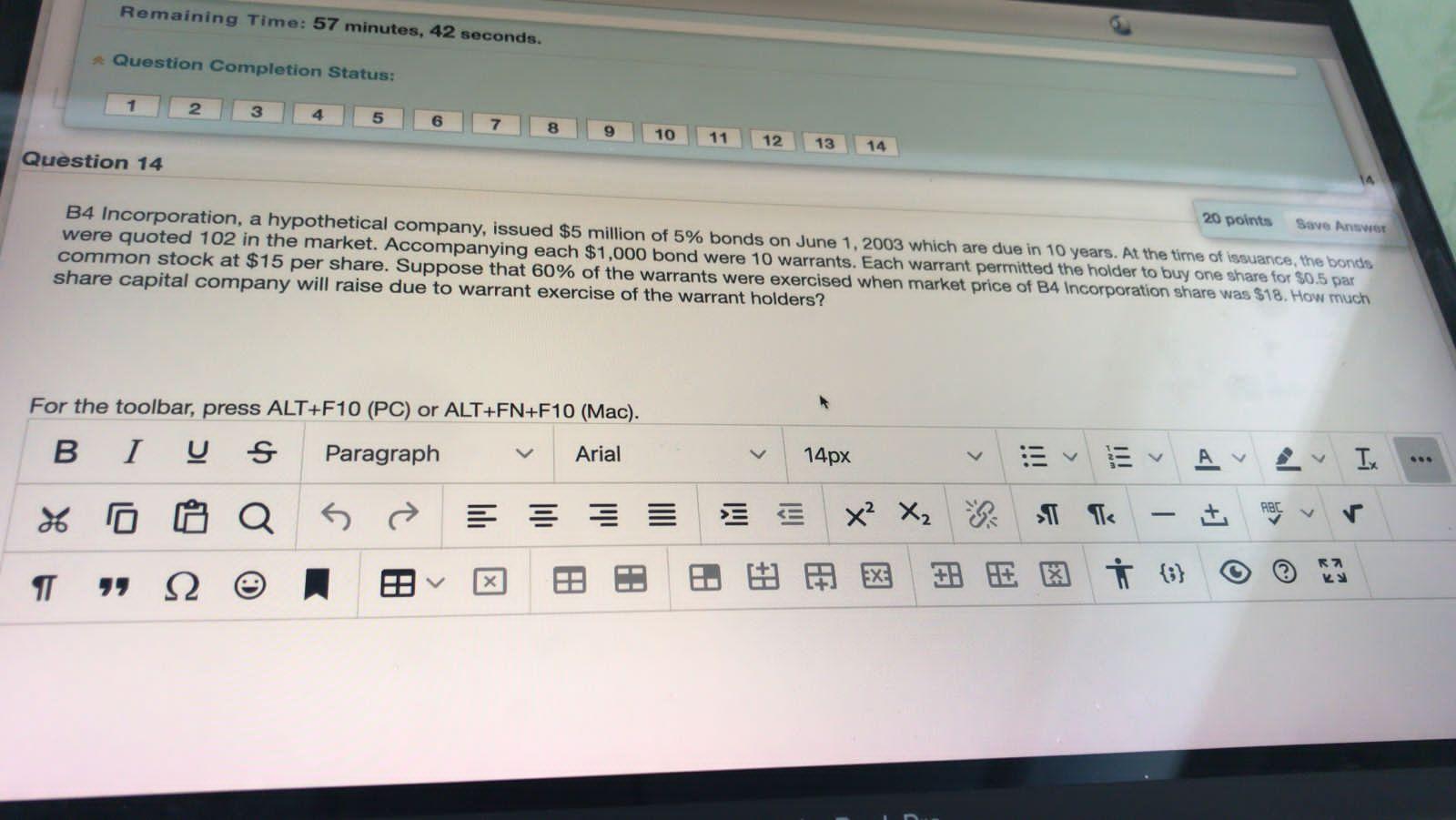

Remaining Time: 57 minutes, 42 seconds. Question Completion Status: 1 2 3 6 7 8 10 11 12 13 14 Question 14 20 points Save Answer B4 Incorporation, a hypothetical company, issued $5 million of 5% bonds on June 1, 2003 which are due in 10 years. At the time of issuance, the bonds were quoted 102 in the market. Accompanying each $1,000 bond were 10 warrants. Each warrant permitted the holder to buy one share for $0.5 par common stock at $15 per share. Suppose that 60% of the warrants were exercised when market price of B4 Incorporation share was $18. How much share capital company will raise due to warrant exercise of the warrant holders? For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). B I S Paragraph Arial 14px ini TE . 4 Q lui X X v Te +] R7 12 x 1. EX +H H+ 2 s}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts