Question: Required: 1 . Using the 2 0 X 1 data in the Gaming Table Cost Data tab, create an Excel spreadsheet to provide a sensitivity

Required:

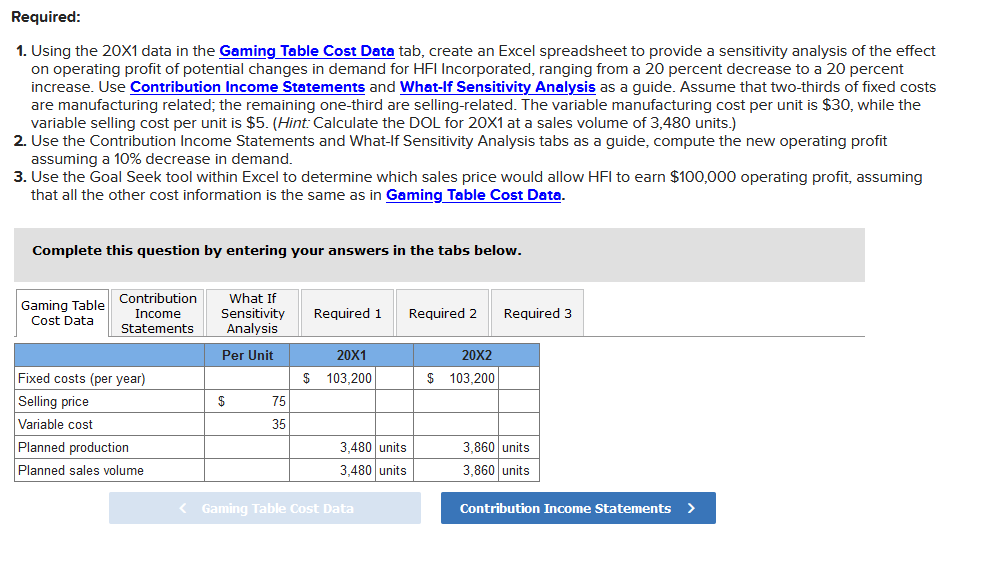

Using the X data in the Gaming Table Cost Data tab, create an Excel spreadsheet to provide a sensitivity analysis of the effect on operating profit of potential changes in demand for HFI Incorporated, ranging from a percent decrease to a percent increase. Use Contribution Income Statements and WhatIf Sensitivity Analysis as a guide. Assume that twothirds of fixed costs are manufacturing related; the remaining onethird are sellingrelated. The variable manufacturing cost per unit is $ while the variable selling cost per unit is $ Hint: Calculate the DOL for times at a sales volume of units.

Use the Contribution Income Statements and WhatIf Sensitivity Analysis tabs as a guide, compute the new operating profit assuming a decrease in demand.

Use the Goal Seek tool within Excel to determine which sales price would allow HFI to earn $ operating profit, assuming that all the other cost information is the same as in Gaming Table Cost Data.

Complete this question by entering your answers in the tabs below. Required:

Using the X data in the Gaming Table Cost Data tab, create an Excel spreadsheet to provide a sensitivity analysis of the effect on operating profit of potential changes in demand for HFI Incorporated, ranging from a percent decrease to a percent increase. Use Contribution Income Statements and WhatIf Sensitivity Analysis as a guide. Assume that twothirds of fixed costs are manufacturing related; the remaining onethird are sellingrelated. The variable manufacturing cost per unit is $ while the variable selling cost per unit is $ Hint: Calculate the DOL for X at a sales volume of units.

Use the Contribution Income Statements and WhatIf Sensitivity Analysis tabs as a guide, compute the new operating profit assuming a decrease in demand.

Use the Goal Seek tool within Excel to determine which sales price would allow HFI to earn $ operating profit, assuming that all the other cost information is the same as in Gaming Table Cost Data.

Complete this question by entering your answers in the tabs below. Using the X data in the Gaming Table Cost Data tab, create an Excel spreadsheet to provide a sensitivity analysis of the effect on operating profit of potential changes in demand for HFI Incorporated, ranging from a percent decrease to a percent increase. Use Contribution Income Statements and WhatIf Sensitivity Analysis as a guide. Assume that twothirds of fixed costs are manufacturing related; the remaining onethird are sellingrelated. The variable manufacturing cost per unit is $ while the variable selling cost per unit is $ Hint: Calculate the DOL for times at a sales volume of units.

Use the Contribution Income Statements and WhatIf Sensitivity Analysis tabs as a guide, compute the new operating profit assuming a decrease in demand.

Use the Goal Seek tool within Excel to determine which sales price would allow HFI to earn $ operating profit, assuming that all the other cost information is the same as in Gaming Table Cost Data.

Complete this question by entering your answers in the tabs below. Required:

Using the X data in the Gaming Table Cost Data tab, create an Excel spreadsheet to provide a sensitivity analysis of the effect on operating profit of potential changes in demand for HFI Incorporated, ranging from a percent decrease to a percent increase. Use Contribution Income Statements and WhatIf Sensitivity Analysis as a guide. Assume that twothirds of fixed costs are manufacturing related; the remaining onethird are sellingrelated. The variable manufacturing cost per unit is $ while the variable selling cost per unit is $Hint: Calculate the DOL for X at a sales volume of units.

Use the Contribution Income Statements and WhatIf Sensitivity Analysis tabs as a guide, compute the new operating profit assuming a decrease in demand.

Use the Goal Seek tool within Excel to determine which sales price would allow HFI to earn $ operating profit, assuming that all the other cost information is the same as in Gaming Table Cost Data.

Complete this question by entering your answers in the tabs below.

Using the X data in the Gaming Table Cost Data tab, create an Excel spreadsheet to provide a sensitivity analysis of the effect on operating profit of potential changes in demand for HFI Incorporated, ranging from a percent decrease to a percent increase. Use Contribution Income Statements and WhatIf Sensitivity Analysis as a guide. Assume that twothirds of fixed costs are manufacturing related; the remaining onethird are sellingrelated. The variable manufacturing cost per unit is $ while the variable selling cost per unit is $ Hint: Calculate the DOL for times at a sales volume of units. Note: Input your answer as a percentage rounded to decimal places ie Required:

Using the X data in the Gaming Table Cost Data tab, create an Excel spreadsheet to p

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock