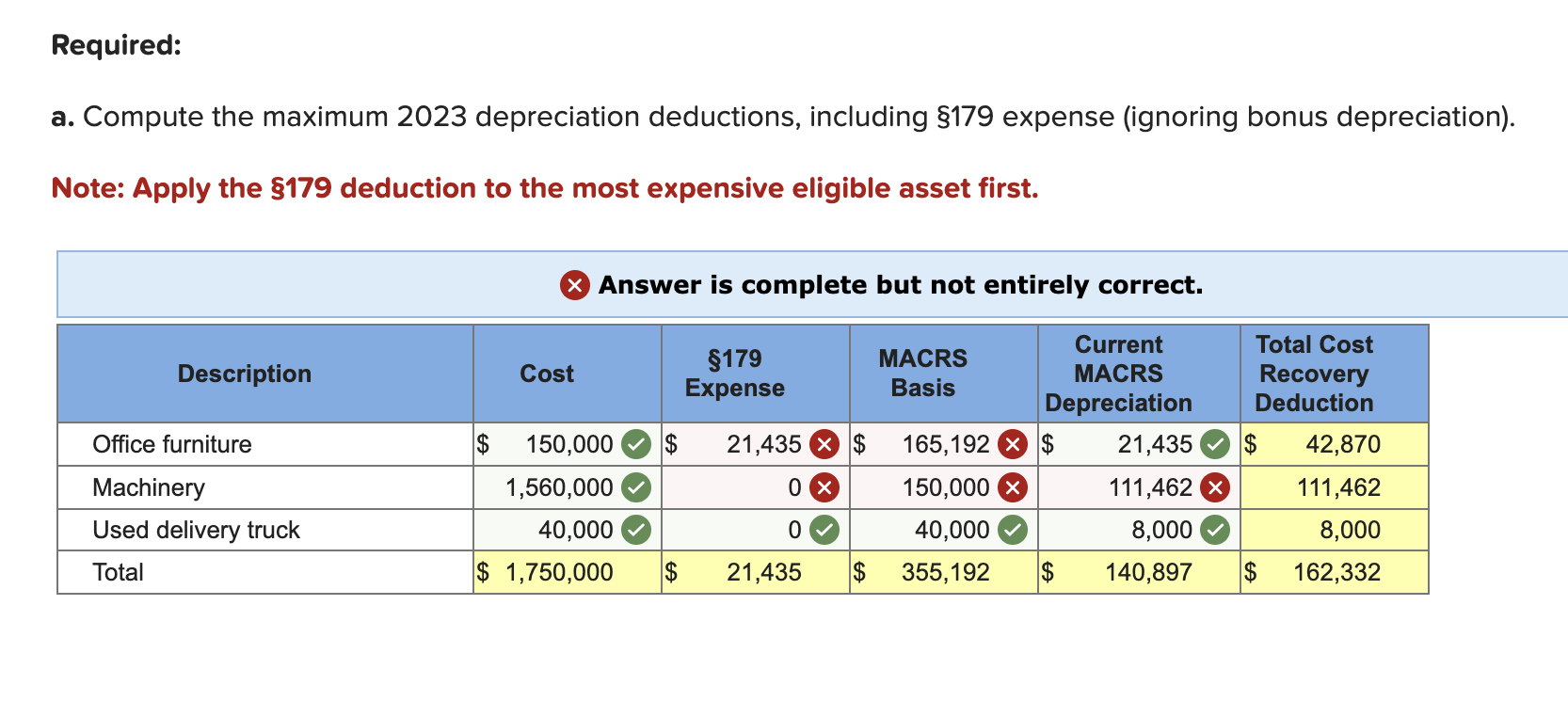

Question: Required: a . Compute the maximum 2 0 2 3 depreciation deductions, including ( S 1 7 9 ) expense ( ignoring

Required: a Compute the maximum depreciation deductions, including S expense ignoring bonus depreciation Note: Apply the S deduction to the most expensive eligible asset first. Answer is complete but not entirely correct. begintabularccccccccccchline Description & & Cost & multicolumnrundersettext Expense $ & multicolumnrMACRS Basis & multicolumnlCurrent MACRS Depreciation & multicolumnlTotal Cost Recovery Deductionhline Office furniture & $ & & $ & & $ & X & $ & & $ & hline Machinery & & & & times & & X & & & & hline Used delivery truck & & & & & & & & & & hline Total & $ & & $ & & $ & & $ & & $ & hline endtabular

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock