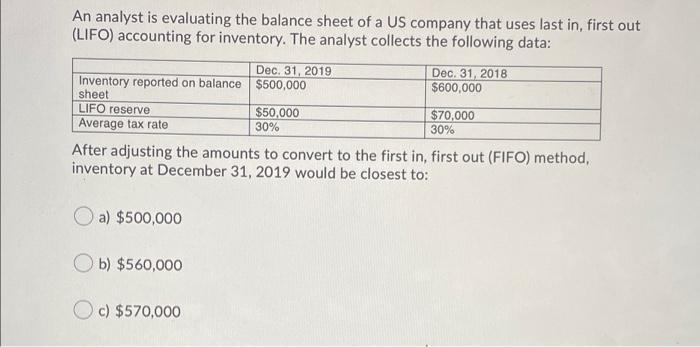

Question: An analyst is evaluating the balance sheet of a US company that uses last in, first out (LIFO) accounting for inventory. The analyst collects

An analyst is evaluating the balance sheet of a US company that uses last in, first out (LIFO) accounting for inventory. The analyst collects the following data: Dec. 31, 2019 Inventory reported on balance $500,000 sheet LIFO reserve Average tax rate a) $500,000 b) $560,000 $50,000 30% After adjusting the amounts to convert to the first in, first out (FIFO) method, inventory at December 31, 2019 would be closest to: c) $570,000 Dec. 31, 2018 $600,000 $70,000 30%

Step by Step Solution

3.43 Rating (159 Votes )

There are 3 Steps involved in it

After adjusting the amounts to convert to the first in first out ... View full answer

Get step-by-step solutions from verified subject matter experts