Question: Required: a) Fill in the cells in the table below to identify cash flows associated with the income from the business if the business is

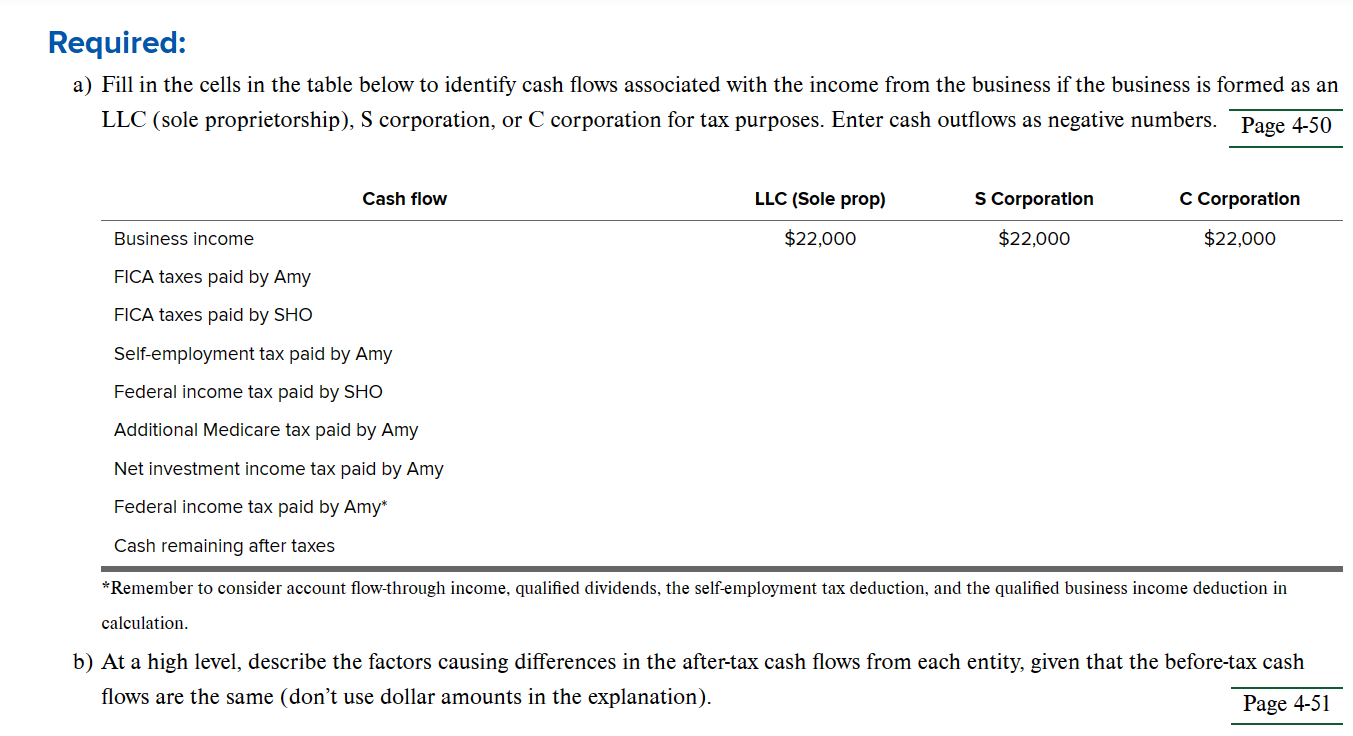

Required:\ a) Fill in the cells in the table below to identify cash flows associated with the income from the business if the business is formed as an\ LLC (sole proprietorship), S corporation, or C corporation for tax purposes. Enter cash outflows as negative numbers.

/bar ( Page 4-50 )\ *Remember to consider account flow-through income, qualified dividends, the self-employment tax deduction, and the qualified business income deduction in\ calculation.\ b) At a high level, describe the factors causing differences in the after-tax cash flows from each entity, given that the before-tax cash\ flows are the same (don't use dollar amounts in the explanation).

Required: a) Fill in the cells in the table below to identify cash flows associated with the income from the business if the business is formed as an LLC (sole proprietorship), S corporation, or C corporation for tax purposes. Enter cash outflows as negative numbers. *Remember to consider account flow-through income, qualified dividends, the self-employment tax deduction, and the qualified business income deduction in calculation. b) At a high level, describe the factors causing differences in the after-tax cash flows from each entity, given that the before-tax cash flows are the same (don't use dollar amounts in the explanation). Page 4-51

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts