Question: Required: a) Fill in the cells in the table below to identify cash flows associated with the income from the business if the business

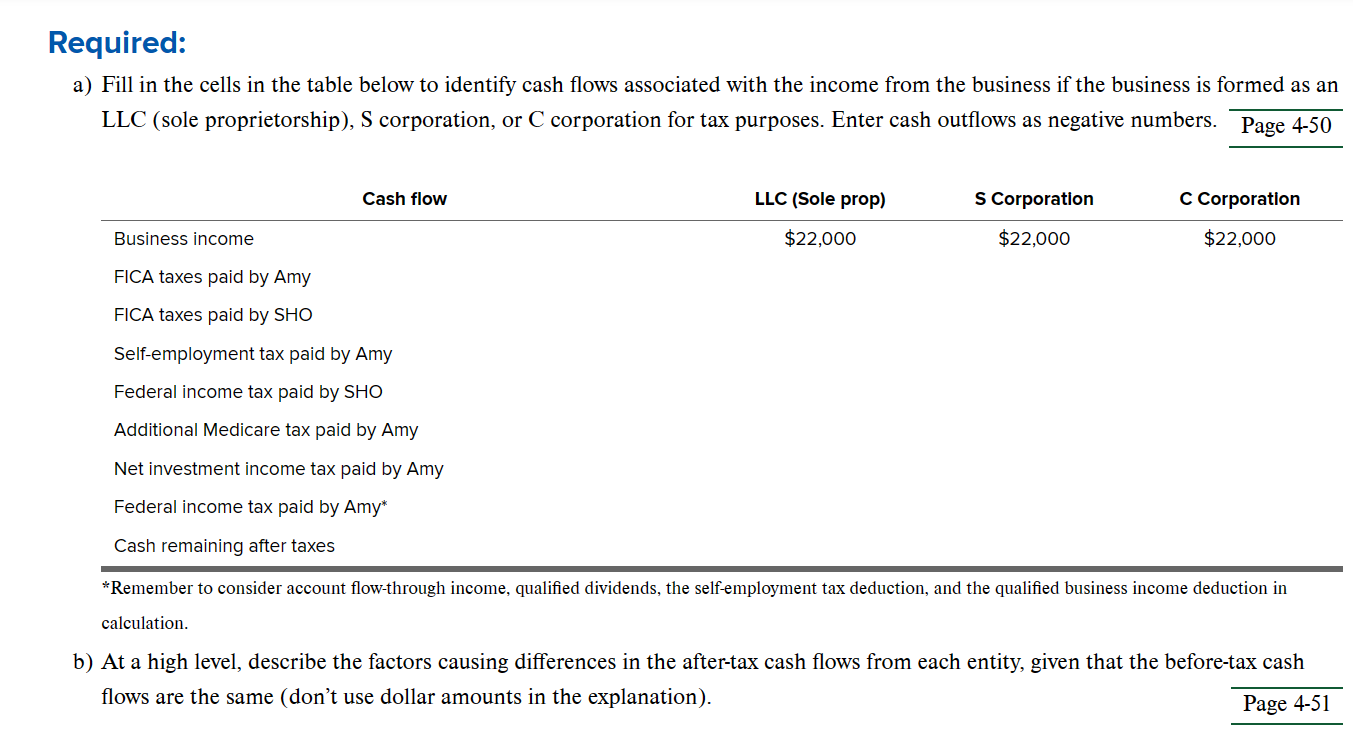

Required: a) Fill in the cells in the table below to identify cash flows associated with the income from the business if the business is formed as an LLC (sole proprietorship), S corporation, or C corporation for tax purposes. Enter cash outflows as negative numbers. Page 4-50 Cash flow LLC (Sole prop) $22,000 S Corporation $22,000 C Corporation $22,000 Business income FICA taxes paid by Amy FICA taxes paid by SHO Self-employment tax paid by Amy Federal income tax paid by SHO Additional Medicare tax paid by Amy Net investment income tax paid by Amy Federal income tax paid by Amy* Cash remaining after taxes *Remember to consider account flow-through income, qualified dividends, the self-employment tax deduction, and the qualified business income deduction in calculation. b) At a high level, describe the factors causing differences in the after-tax cash flows from each entity, given that the before-tax cash flows are the same (don't use dollar amounts in the explanation). Page 4-51

Step by Step Solution

There are 3 Steps involved in it

a LLC Sole Proprietorship S Corporation C Corporation Business income 22000 22000 22000 FICA taxes paid by Amy 155940 Cash flow 2044060 22000 22000 FI... View full answer

Get step-by-step solutions from verified subject matter experts