Question: Required information Comprehenslve Problem 1 1 - 7 1 ( LO 1 1 - 1 , LO 1 1 - 2 , LO 1 1

Required information

Comprehenslve Problem LO LO LO LO LO LO Algo

The following information applies to the questlons allsplayed below.

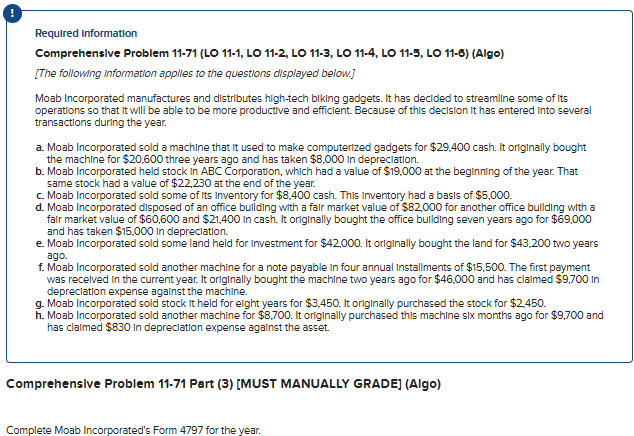

Moab Incorporated manufactures and distributes hightech biking gadgets. It has decided to streamline some of its operations so that it will be able to be more productive and efficient. Because of this decision it has entered into several transactlons during the year.

a Moab Incorporated sold a machine that It used to make computerized gadgets for $ cash. It originally bought the machine for $ three years ago and has taken $ in depreclation.

b Moab Incorporated held stock In ABC Corporation, which had a value of $ at the beginning of the year. That same stock had a value of $ at the end of the year.

c Moab Incorporated sold some of Its inventory for $ cash. This inventory had a basis of $

d Moab Incorporated disposed of an office bulding with a falr market value of $ for another office building with a fair market value of $ and $ in cash. It orlginally bought the office bulding seven years ago for $ and has taken $ in depreclation.

e Moab Incorporated sold some land held for irvestment for $ It originally bought the land for $ two years ago.

f Moab Incorporated sold another machine for a note payable in four annual Installments of $ The first payment was recelved in the current year. It orliginally bought the machine two years ago for $ and has claimed $ in depreciation expense against the machine.

g Moab Incorporated sold stock it held for elight years for $ It originally purchased the stock for $

h Moab Incorporated sold another machine for $ It originally purchased this machine six months ago for $ and has claimed $ in depreclation expense against the asset.

Comprehenslve Problem Part MUST MANUALLY GRADEAlgo

Complete Moab Incorporated's Form for the year.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock