Question: ! Required information Determine 1 0 % - per - year present worth ( PW ) of taxes over a 6 - year study period.

Required information

Determine peryear present worth PW

of taxes over a year study period.

$$ and

Use straight line method to determine the present worth

PW of the tax with years.

The PW of taxes is determined to be $

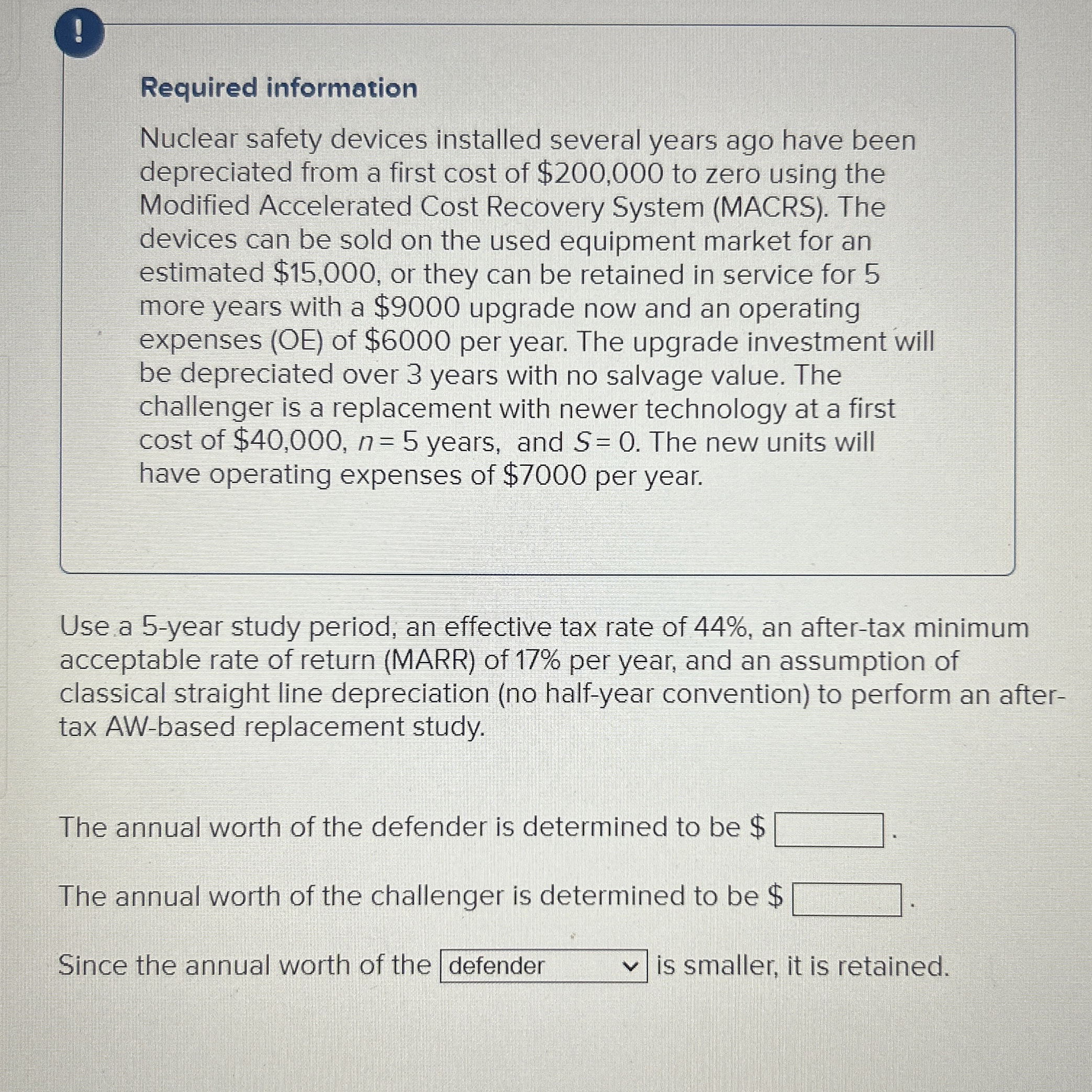

Required information

Nuclear safety devices installed several years ago have been

depreciated from a first cost of $ to zero using the

Modified Accelerated Cost Recovery System MACRS The

devices can be sold on the used equipment market for an

estimated $ or they can be retained in service for

more years with a $ upgrade now and an operating

expenses OE of $ per year. The upgrade investment will

be depreciated over years with no salvage value. The

challenger is a replacement with newer technology at a first

cost of $ years, and The new units will

have operating expenses of $ per year.

Use a year study period, an effective tax rate of an aftertax minimum

acceptable rate of return MARR of per year, and an assumption of

classical straight line depreciation no halfyear convention to perform an after

tax AWbased replacement study.

The annual worth of the defender is determined to be $

The annual worth of the challenger is determined to be $

Since the annual worth of the

is smaller, it is retained.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock