Question: Required information Exercise 4-2 Compute Activity Rates (L04-2] [The following information applies to the questions displayed below) Rustafson Corporation is a diversified manufacturer of consumer

![Required information Exercise 4-2 Compute Activity Rates (L04-2] [The following information](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66fadcece582e_58866fadcec33c6b.jpg)

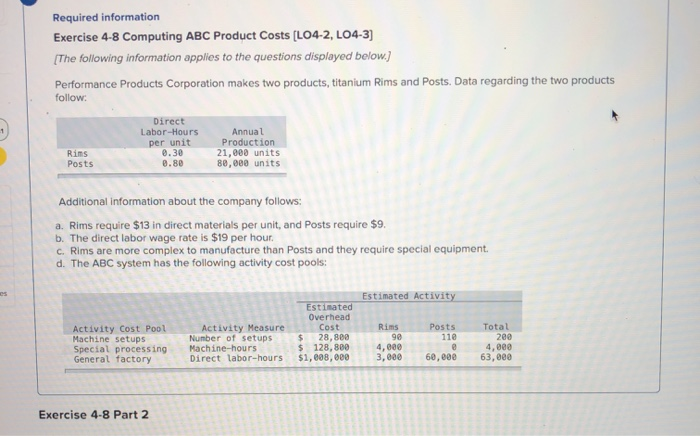

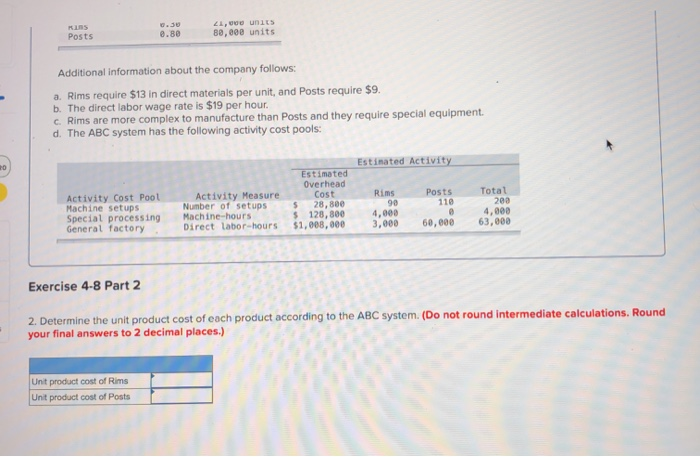

Required information Exercise 4-2 Compute Activity Rates (L04-2] [The following information applies to the questions displayed below) Rustafson Corporation is a diversified manufacturer of consumer goods. The company's activity-based costing system has the following seven activity cost pools: Estimated Overhead Expected Activity Cost Pool Cost Activity Labor-related $ 20,400 10,000 direct labor-hours Machine-related $ 2,000 8,000 machine-hours Machine setups $ 20,400 600 setups Production orders $ 18,400 400 orders Product testing $ 29,600 800 tests Packaging $ 79,200 3,600 packages General factory $ 58,000 10,000 direct labor-hours Exercise 4-2 Part 2 2. Compute the company's predetermined overhead rate, assuming that the company uses a single plantwide predetermined overhead rate based on direct labor-hours. (Round your answer to 2 decimal places.) Predetermined overhead rate per DLH Required information Exercise 4-8 Computing ABC Product Costs (L04-2, L04-3) [The following information applies to the questions displayed below) Performance Products Corporation makes two products, titanium Rims and Posts. Data regarding the two products follow: Direct Labor-Hours per unit 0.30 8.80 Annual Production 21,000 units 80,000 units Rims Posts Additional information about the company follows: a. Rims require $13 in direct materials per unit, and Posts require $9. b. The direct labor wage rate is $19 per hour. C. Rims are more complex to manufacture than Posts and they require special equipment d. The ABC system has the following activity cost pools: Estimated Activity Activity Cost Pool Machine setups Special processing General factory Activity Measure Number of setups Machine-hours Direct labor-hours Estimated Overhead Cost $ 28,800 $ 128,800 $1,008,000 Rims 90 4,000 3,000 Posts 110 @ 60,000 Total 200 4,000 63,000 Exercise 4-8 Part 2 RS Posts 0.80 21,00 units 80,000 units Additional information about the company follows: a. Rims require $13 in direct materials per unit, and Posts require $9. b. The direct labor wage rate is $19 per hour. c. Rims are more complex to manufacture than Posts and they require special equipment. d. The ABC system has the following activity cost pools: Estimated Activity Posts 110 Activity Cost Pool Machine setups Special processing General factory Estimated Overhead Cost 5 28,800 $ 128,800 $1,000,000 Activity Measure Number of setups Machine-hours Direct labor-hours Rims 90 4,000 3,000 Total 200 4,000 63,000 60,000 Exercise 4-8 Part 2 2. Determine the unit product cost of each product according to the ABC system (Do not round intermediate calculations. Round your final answers to 2 decimal places.) Unit product cost of Rims Unit product cost of Posts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts