Question: Required information Lab Note: The tools presented in this lab periodically change. Updated instructions, if applicable, can be found in the eBook and lab walkthrough

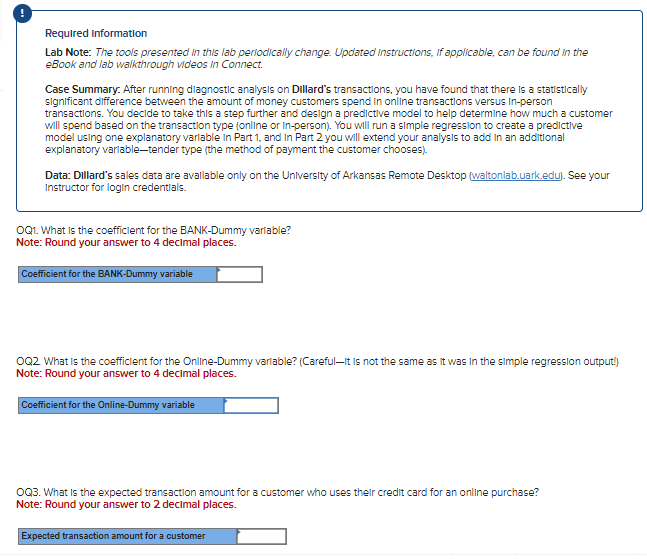

Required information Lab Note: The tools presented in this lab periodically change. Updated instructions, if applicable, can be found in the eBook and lab walkthrough videos in Connect. Case Summary. After running diagnostic analysis on Dillard's transactions, you have found that there is a statistically significant difference between the amount of money customers spend in online transactions versus in-person transactions. You decide to take this a step further and design a predictive model to help determine how much a customer Will spend based on the transaction type (online or in-person). You will run a simple regression to create a predictlve model using one explanatory varlable in Part 1, and in Part 2 you will extend your analysis to add In an additional explanatory varlable-tender type (the method of payment the customer chooses). Data: Dillard's sales data are avallable only on the Unlversity of Arkansas Remote Desktop (waltonlab.uark.edu). See your instructor for login credentials. OQ1. What is the coefficlent for the BANK-Dummy varlable? Note: Round your answer to 4 decimal places. OQ2 What is the coefficient for the Online-Dummy varlable? (Careful-It is not the same as it was in the simple regression outputi) Note: Round your answer to 4 decimal places. OQ3. What is the expected transaction amount for a customer who uses their credit card for an online purchase? Note: Round your answer to 2 decimal places. Required information Lab Note: The tools presented in this lab periodically change. Updated instructions, if applicable, can be found in the eBook and lab walkthrough videos in Connect. Case Summary. After running diagnostic analysis on Dillard's transactions, you have found that there is a statistically significant difference between the amount of money customers spend in online transactions versus in-person transactions. You decide to take this a step further and design a predictive model to help determine how much a customer Will spend based on the transaction type (online or in-person). You will run a simple regression to create a predictlve model using one explanatory varlable in Part 1, and in Part 2 you will extend your analysis to add In an additional explanatory varlable-tender type (the method of payment the customer chooses). Data: Dillard's sales data are avallable only on the Unlversity of Arkansas Remote Desktop (waltonlab.uark.edu). See your instructor for login credentials. OQ1. What is the coefficlent for the BANK-Dummy varlable? Note: Round your answer to 4 decimal places. OQ2 What is the coefficient for the Online-Dummy varlable? (Careful-It is not the same as it was in the simple regression outputi) Note: Round your answer to 4 decimal places. OQ3. What is the expected transaction amount for a customer who uses their credit card for an online purchase? Note: Round your answer to 2 decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts