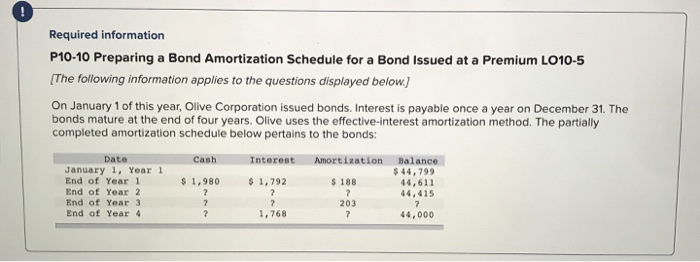

Question: Required information P10-10 Preparing a Bond Amortization Schedule for a Bond Issued at a Premium LO10-5 [The following information applies to the questions displayed below.]

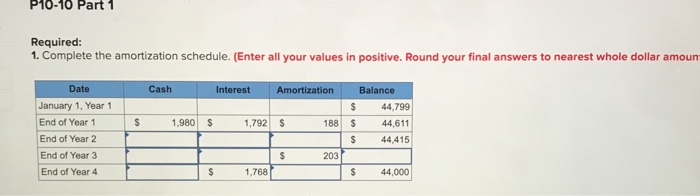

Required information P10-10 Preparing a Bond Amortization Schedule for a Bond Issued at a Premium LO10-5 [The following information applies to the questions displayed below.] On January 1 of this year, Olive Corporation issued bonds. Interest is payable once a year on December 31. The bonds mature at the end of four years. Olive uses the effective-interest amortization method. The partially completed amortization schedule below pertains to the bonds: Cash Interest Amortization $ 1,980 $1,792 Date January 1, Year 1 End of Year 1 End of Year 2 End of Year 3 End of Year 4 $ 188 Balance $ 44,799 44,611 44,415 7 44,000 203 1,768 P10-10 Part 1 Required: 1. Complete the amortization schedule. (Enter all your values in positive. Round your final answers to nearest whole dollar amoun Cash Interest Amortization Date January 1, Year 1 End of Year 1 End of Year 2 End of Year 3 End of Year 4 $ 1,980 $ 1,792 S 188 Balance $ 44,799 $ 44,611 $ 44,415 $ 203 $ 1,768 $ 44,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts