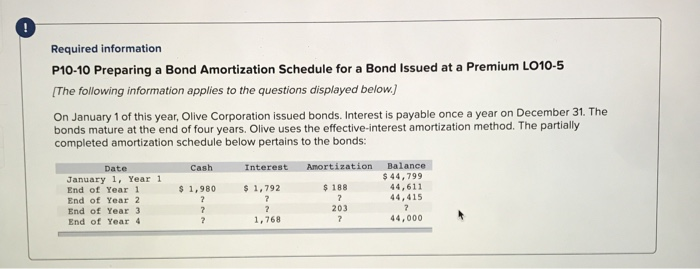

Question: Required information P10-10 Preparing a Bond Amortization Schedule for a Bond Issued at a Premium LO10-5 The following information applies to the questions displayed below)

Required information P10-10 Preparing a Bond Amortization Schedule for a Bond Issued at a Premium LO10-5 The following information applies to the questions displayed below) On January 1 of this year, Olive Corporation issued bonds. Interest is payable once a year on December 31. The bonds mature at the end of four years. Olive uses the effective interest amortization method. The partially completed amortization schedule below pertains to the bonds: Cash Interest Amortization Date January 1, Year 1 End of Year 1 End of Year 2 End of Year 3 End of Year 4 $ 1,980 $ 1,792 Balance $ 44,799 44,611 44,415 $ 188 1.768 44,000 2. When the bonds mature at the end of Year 4, what amount of principal will Olive pay investors? wwwwwwwwwwwwwww Principal amount

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts