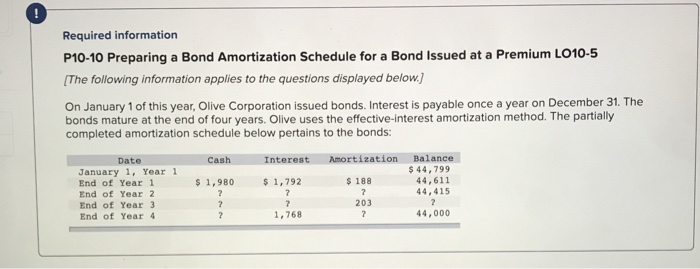

Question: Required information P10-10 Preparing a Bond Amortization Schedule for a Bond Issued at a Premium LO10-5 [The following information applies to the questions displayed below.)

Required information P10-10 Preparing a Bond Amortization Schedule for a Bond Issued at a Premium LO10-5 [The following information applies to the questions displayed below.) On January 1 of this year, Olive Corporation issued bonds. Interest is payable once a year on December 31. The bonds mature at the end of four years. Olive uses the effective interest amortization method. The partially completed amortization schedule below pertains to the bonds: Cash Interest Amortization Date January 1, Year 1 End of Year 1 End of Year 2 End of Year 3 End of Year 4 $1,980 $1,792 Balance $ 44,799 44,611 44, 415 $ 188 203 1.768 44,000 P10-10 Part 4 4. Were the bonds issued at a premium or a discount? If so, what was the amount of the premium or discount

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts