Question: Required information Problem 1 2 - 4 1 ( LO 1 2 - 3 ) ( Algo ) [ The following information applies to the

Required information

Problem LO Algo

The following information applies to the questions displayed below.

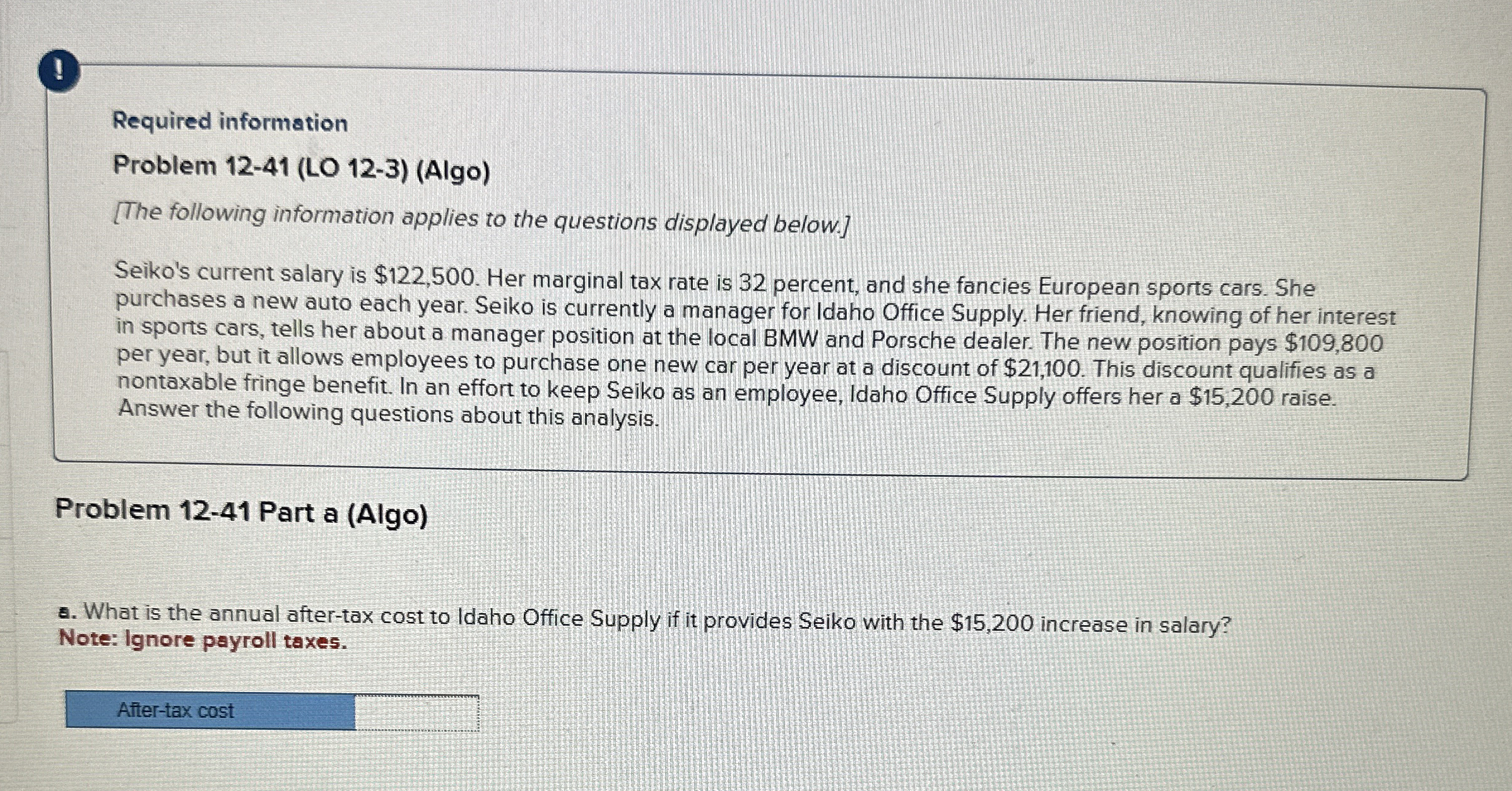

Seiko's current salary is $ Her marginal tax rate is percent, and she fancies European sports cars. She

purchases a new auto each year. Seiko is currently a manager for Idaho Office Supply. Her friend, knowing of her interest

in sports cars, tells her about a manager position at the local BMW and Porsche dealer. The new position pays $

per year, but it allows employees to purchase one new car per year at a discount of $ This discount qualifies as a

nontaxable fringe benefit. In an effort to keep Seiko as an employee, Idaho Office Supply offers her a $ raise.

Answer the following questions about this analysis.

Problem Part a Algo

a What is the annual aftertax cost to Idaho Office Supply if it provides Seiko with the $ increase in salary?

Note: Ignore payroll taxes.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock