Question: ! Required information Problem 7 - 3 9 ( LO 7 - 2 ) ( Static ) [ The following information applies to the questions

Required information

Problem LO Static

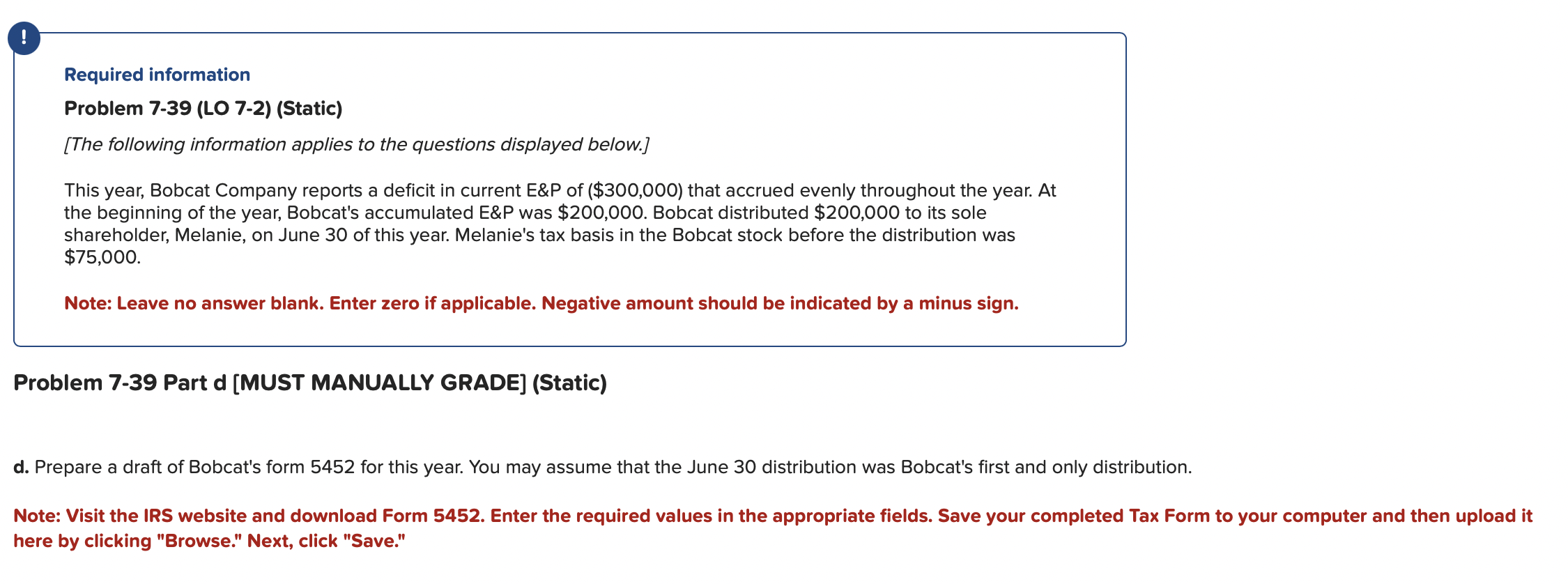

The following information applies to the questions displayed below.

This year, Bobcat Company reports a deficit in current E&P of $ that accrued evenly throughout the year. At the beginning of the year, Bobcat's accumulated E&P was $ Bobcat distributed $ to its sole shareholder, Melanie, on June of this year. Melanie's tax basis in the Bobcat stock before the distribution was $

Note: Leave no answer blank. Enter zero if applicable. Negative amount should be indicated by a minus sign.

Problem Part d MUST MANUALLY GRADEStatic

d Prepare a draft of Bobcat's form for this year. You may assume that the June distribution was Bobcat's first and only distribution.

Note: Visit the IRS website and download Form Enter the required values in the appropriate fields. Save your completed Tax Form to your computer and then upload it here by clicking "Browse." Next, click "Save."

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock