Question: Required: Prepare a comprehensive income statement for 2022 using the one statement approach. The following information was taken from the records of Wildhorse SA for

Required:

Required:

Prepare a comprehensive income statement for 2022 using the one statement approach.

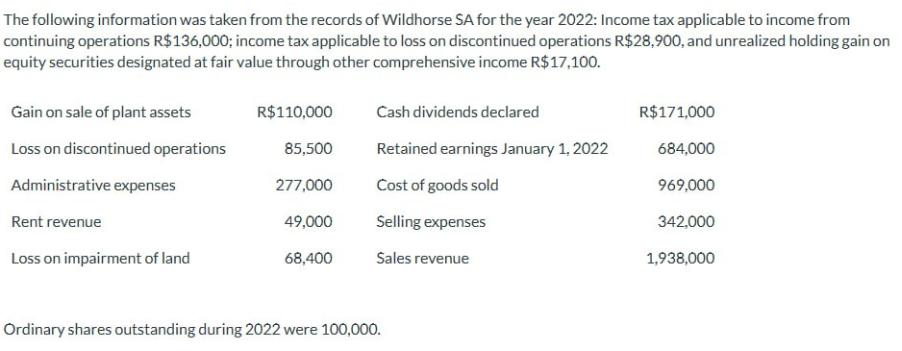

The following information was taken from the records of Wildhorse SA for the year 2022: Income tax applicable to income from continuing operations R$ 136,000; income tax applicable to loss on discontinued operations R$28,900, and unrealized holding gain on equity securities designated at fair value through other comprehensive income R$17,100. Gain on sale of plant assets Loss on discontinued operations Administrative expenses Rent revenue Loss on impairment of land R$ 110,000 85,500 277,000 49,000 68,400 Cash dividends declared Retained earnings January 1, 2022 Cost of goods sold Selling expenses Sales revenue Ordinary shares outstanding during 2022 were 100,000. R$ 171,000 684,000 969,000 342,000 1,938,000

Step by Step Solution

3.36 Rating (149 Votes )

There are 3 Steps involved in it

Income Statement An income Statement is a financial statement that includes revenue earned and expen... View full answer

Get step-by-step solutions from verified subject matter experts