Question: Requirements 1. Compute the predetermined overhead allocation rate per direct labor dollar. 2. Prepare the journal entry to allocate overhead cost for the year. 3.

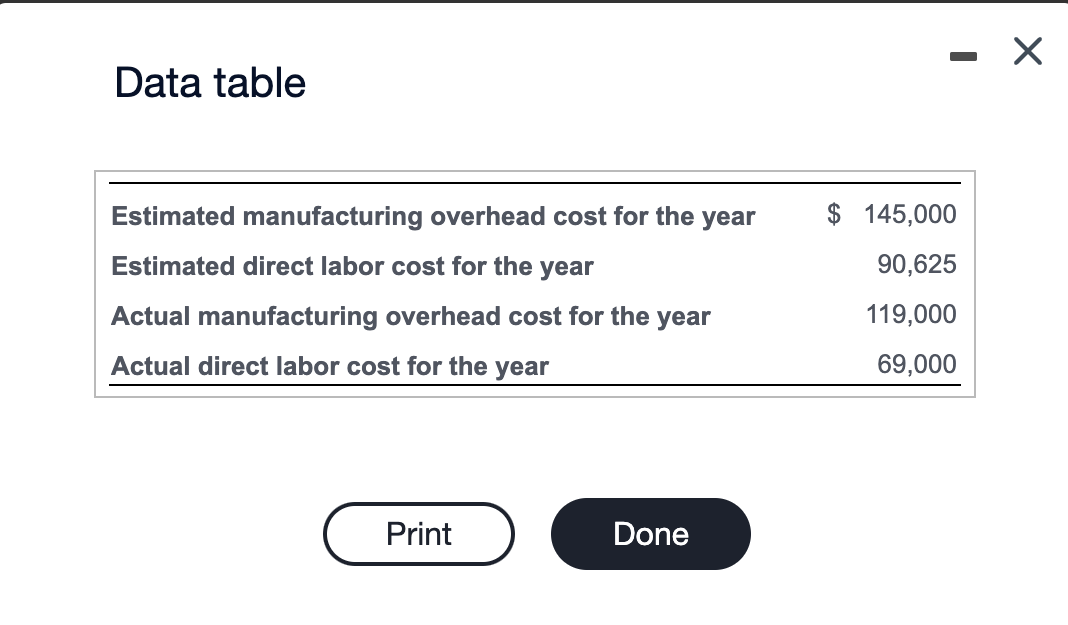

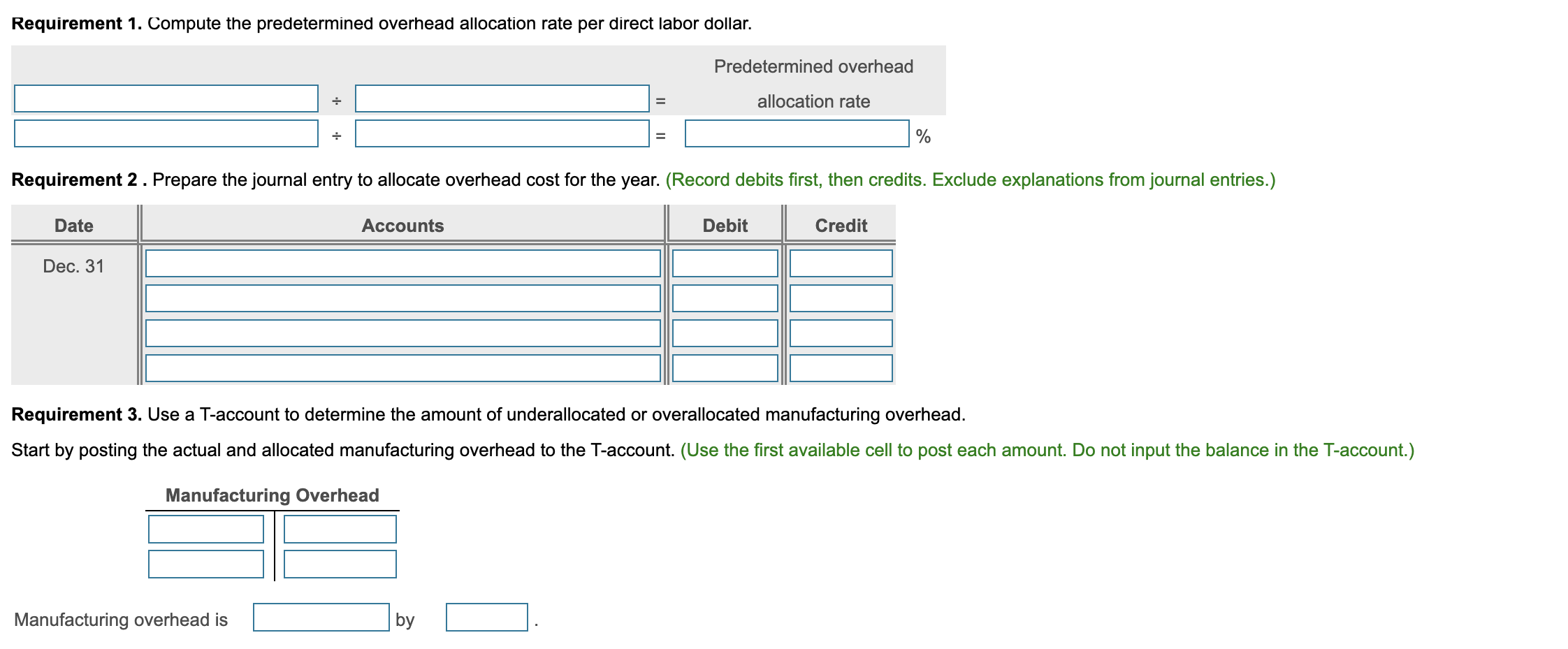

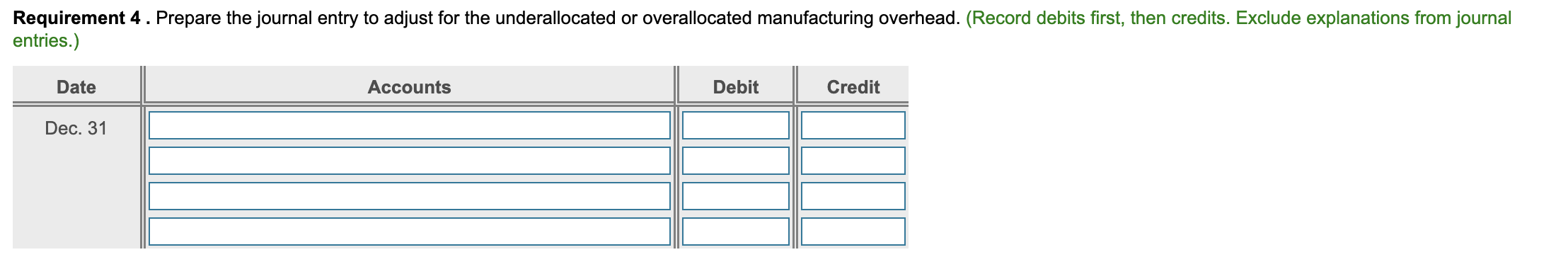

Requirements 1. Compute the predetermined overhead allocation rate per direct labor dollar. 2. Prepare the journal entry to allocate overhead cost for the year. 3. Use a T-account to determine the amount of underallocated or overallocated maunfacturing overhead. 4. Prepare the journal entry to adjust for the underallocated or overallocated manufacturing overhead. Data table Requirement 1. Compute the predetermined overhead allocation rate per direct labor dollar. Requirement 2. Prepare the journal entry to allocate overhead cost for the year. (Record debits first, then credits. Exclude explanations from journal entries.) Requirement 3. Use a T-account to determine the amount of underallocated or overallocated manufacturing overhead. Start by posting the actual and allocated manufacturing overhead to the T-account. (Use the first available cell to post each amount. Do not input the balance in the T-account.) entries.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts