Question: Requirements: Using the data below, record all the required journal entries for the following problem in appropriate professional Excel format ( i . e .

Requirements:

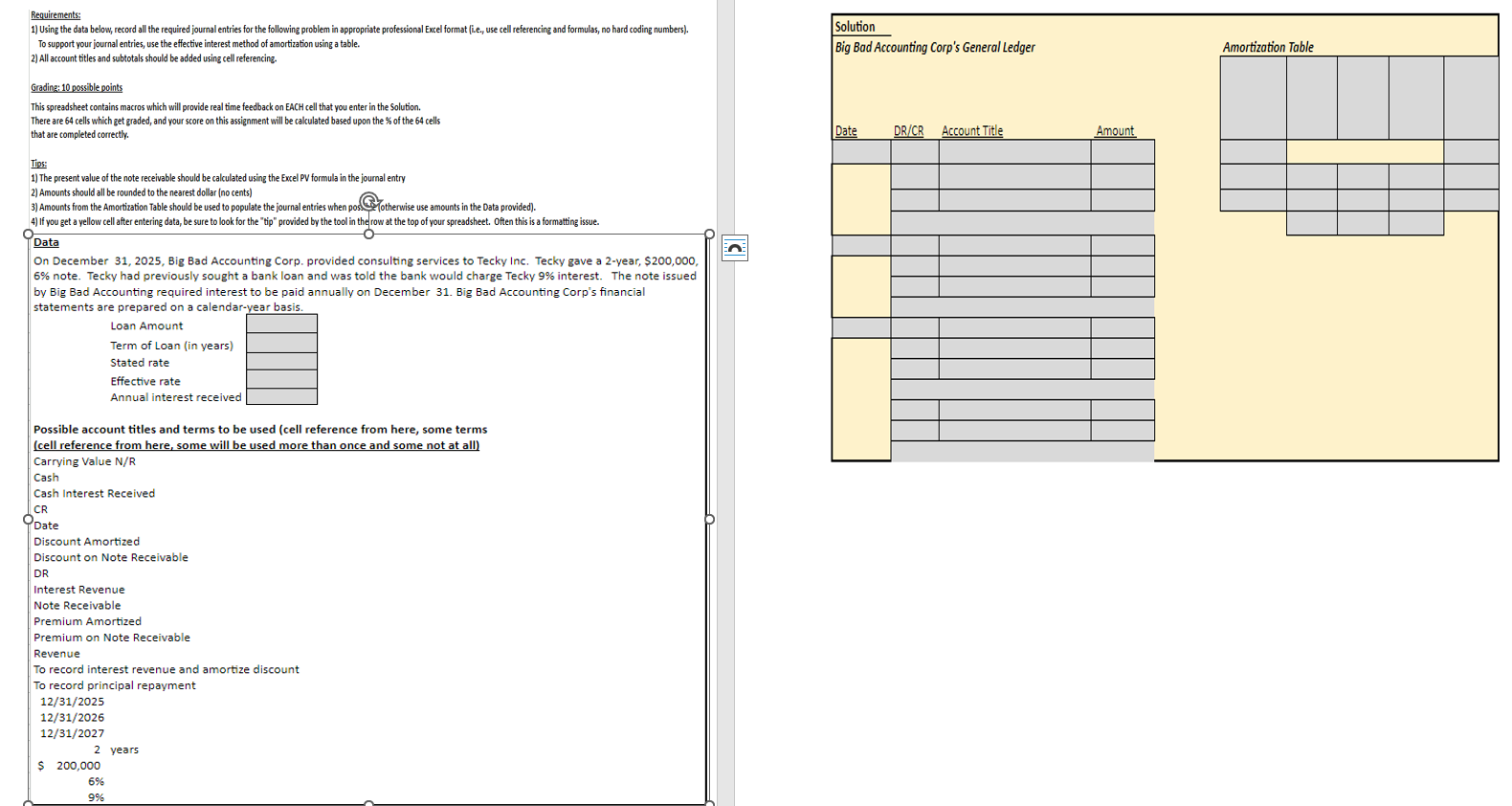

Using the data below, record all the required journal entries for the following problem in appropriate professional Excel format ie use cell referencing and formulas, no hard coding numbers

To support your journal entries, use the effective interest method of amortization using a table.

All account titles and subtotals should be added using cell referencing.

Grading: possible points

This spreadsheet contains macros which will provide real time feedback on EACH cell that you enter in the Solution.

There are cells which get graded, and your score on this assignment will be calculated based upon the of the cells

that are completed correctly.

Tips:

The present value of the note receivable should be calculated using the Excel PV formula in the journal entry

Amounts should all be rounded to the nearest dollar no cents

Amounts from the Amortization Table should be used to populate the journal entries when pos otherwise use amounts in the Data provided

If you get a yellow cell after entering data, be sure to look for the "tip" provided by the tool in the row at the top of your spreadsheet. Often this is a formatting issue.

Data

On December Big Bad Accounting Corp. provided consulting services to Tecky Inc. Tecky gave a year, $

note. Tecky had previously sought a bank loan and was told the bank would charge Tecky interest. The note issued

by Big Bad Accounting required interest to be paid annually on December Big Bad Accounting Corp's financial

statements are prepared on a calendaryear basis.

tableLoan Amount,Term of Loan in yearsStated rate,Effective rate,Annual interest received,

Possible account titles and terms to be used cell reference from here, some terms

cell reference from here, some will be used more than once and some not at all

Carrying Value NR

Cash

Cash Interest Received

CR

Date

Discount Amortized

Discount on Note Receivable

DR

Interest Revenue

Note Receivable

Premium Amortized

Premium on Note Receivable

Revenue

To record interest revenue and amortize discount

To record principal repayment

years

$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock