Question: Requirements: Using the data below, record all the equired joumal entries for the following problem in appropriate professlonal Excel format ( i . e .

Requirements:

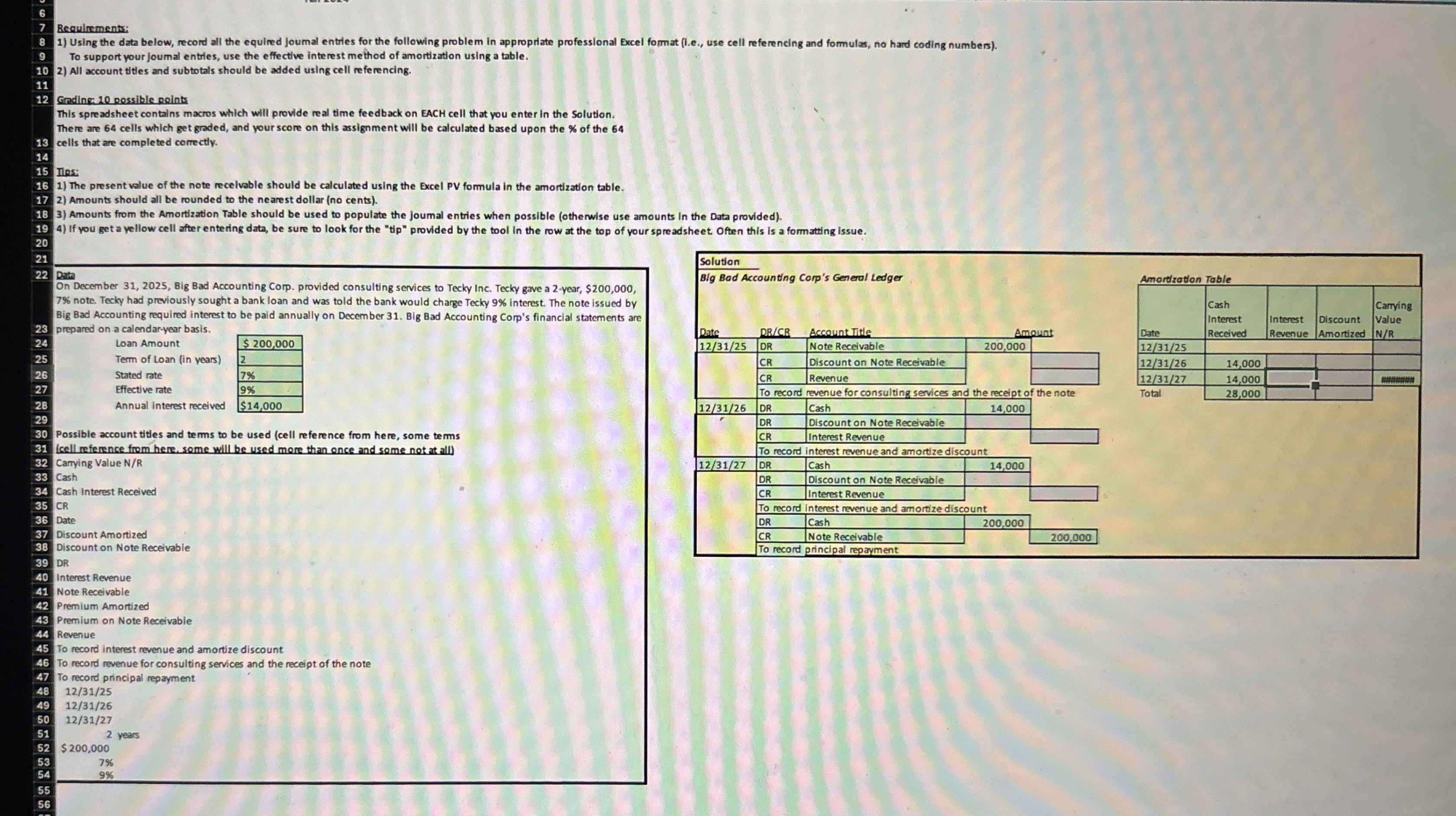

Using the data below, record all the equired joumal entries for the following problem in appropriate professlonal Excel format ie use cell referencing and formulas, no hard coding numbers

To support your joumal entries, use the effective interest method of amortization using a table.

All account titles and subtotals should be added using cell referencing.

Gading: pessible points

This spreadsheet contains macros which will provide real time feedback on EACH cell that you enter in the Solution.

There are cells which get graded, and your score on this assignment will be calculated based upon the of the

cells that are completed correctly.

Hips:

The present value of the note recelvable should be calculated using the Excel PV formula in the amorization table.

Amounts should all be rounded to the nearest dollar no cents

Amounts from the Amorization Table should be used to populate the joumal entries when possible otherwise use amounts in the Data provided

If you get a yellow cell after entering data, be sure to look for the "tip" provided by the tool in the row at the top of vour spreadsheet often this is a formatting issue.

Data On December Big Bad Accounting Corp. provided consulting services to Tecky Inc. Tecky gave a year, $ note. Tecky had previously sought a bank loan and was told the bank would charge Tecky interest. The note issued by Big Bad Accounting required interest to be paid annually on December Big Bad Accounting Corp's financial statements are prepared on a calendaryear basis.

tableLoan Amount,$Term of Loan in vearsstated rate,Effective rate,Annual interest received,$

Possible account titles and terms to be used cell reference from here, some terms cell reference from here, some will be used more than once and some not at all Carying Value

Cash

Cash Interest Received

CR

Date

Discount Amortized

Discount on Note Receivable

DR

Interest Revenue

Note Receivable

Premium Amortized

Premium on Note Receivable

Revenue

To record interest revenue and amortize discount

To record revenue for consulting sevices and the receipt of the note

To record principal repayment

years

$

table

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock