Question: Requlred Information PepsiCo's Diversification in 2 0 2 2 This case is ideal for a module on corporate diversification strategies. The case teaches well because

Requlred Information

PepsiCo's Diversification in

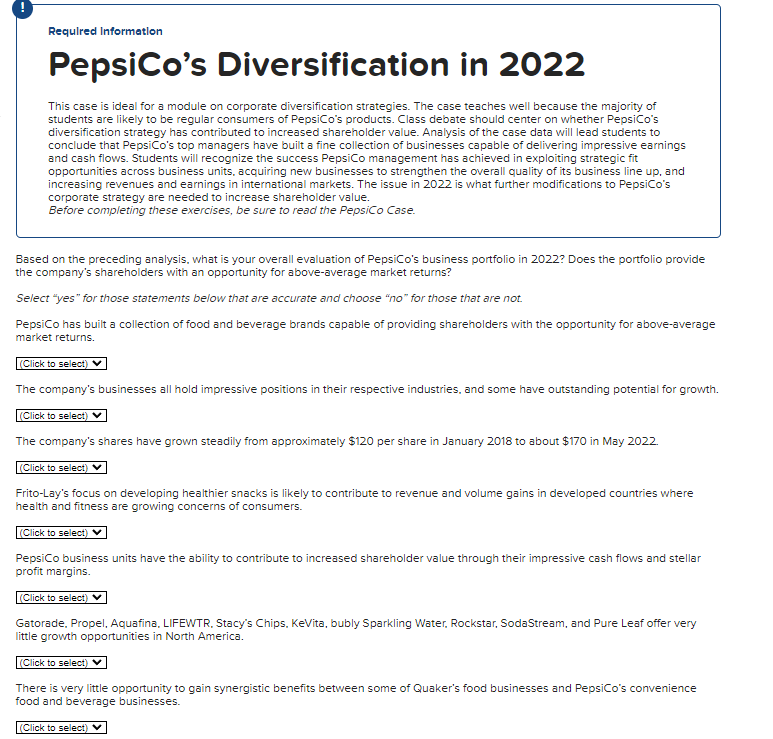

This case is ideal for a module on corporate diversification strategies. The case teaches well because the majority of

students are likely to be regular consumers of PepsiCo's products. Class debate should center on whether PepsiCo's

diversification strategy has contributed to increased shareholder value. Analysis of the case data will lead students to

conclude that PepsiCo's top managers have built a fine collection of businesses capable of delivering impressive earnings

and cash flows. Students will recognize the success PepsiCo management has achieved in exploiting strategic fit

opportunities across business units, acquiring new businesses to strengthen the overall quality of its business line up and

increasing revenues and earnings in international markets. The issue in is what further modifications to PepsiCo's

corporate strategy are needed to increase shareholder value.

Before completing these exercises, be sure to read the Pepsico Case.

Based on the preceding analysis, what is your overall evaluation of PepsiCo's business portfolio in Does the portfolio provide

the company's shareholders with an opportunity for aboveaverage market returns?

Select "yes" for those statements below that are accurate and choose no for those that are not.

Pepsico has built a collection of food and beverage brands capable of providing shareholders with the opportunity for aboveaverage

market returns.

The company's businesses all hold impressive positions in their respective industries, and some have outstanding potential for growth.

The company's shares have grown steadily from approximately $ per share in January to about $ in May

FritoLay's focus on developing healthier snacks is likely to contribute to revenue and volume gains in developed countries where

health and fitness are growing concerns of consumers.

Pepsico business units have the ability to contribute to increased shareholder value through their impressive cash flows and stellar

profit margins.

Gatorade, Propel, Aquafina, LIFEWTR, Stacy's Chips, KeVita, bubly Sparkling Water, Rockstar, SodaStream, and Pure Leaf offer very

little growth opportunities in North America.

There is very little opportunity to gain synergistic benefits between some of Quaker's food businesses and PepsiCo's convenience

food and beverage businesses.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock