Question: Return on Equity (ROE). Return on Assets (ROA). Net interest margin. Earning Per Share (EPS). Net noninterest margin. Net Operating Margin. Earning Spread. 2. Below

- Return on Equity (ROE).

- Return on Assets (ROA).

- Net interest margin.

- Earning Per Share (EPS).

- Net noninterest margin.

- Net Operating Margin.

- Earning Spread.

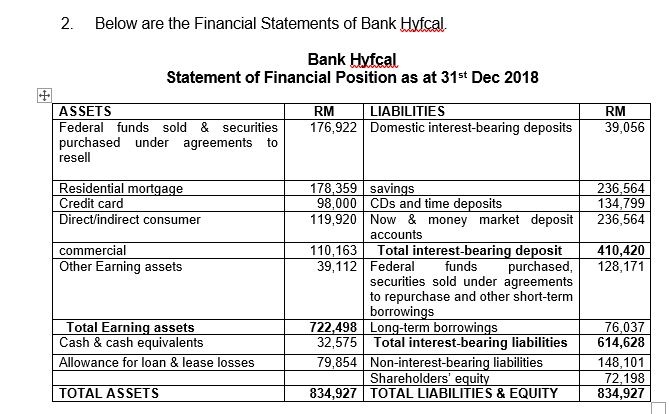

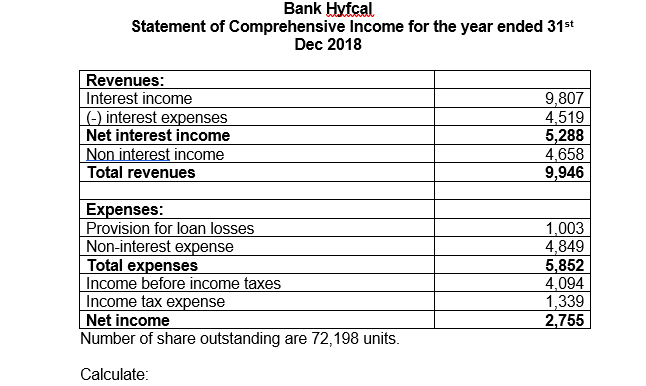

2. Below are the Financial Statements of Bank Hyfcal. Bank Hyfcal Statement of Financial Position as at 31st Dec 2018 ASSETS Federal funds sold & securities purchased under agreements to resell RM LIABILITIES 176,922 Domestic interest-bearing deposits RM 39,056 Residential mortgage Credit card Direct/indirect consumer commercial Other Earning assets 236,564 134,799 236,564 410,420 128,171 178,359 savings 98,000 CDs and time deposits 119,920 Now & money market deposit accounts 110,163 Total interest-bearing deposit 39,112 Federal funds purchased, securities sold under agreements to repurchase and other short-term borrowings 722,498 Long-term borrowings 32,575 Total interest-bearing liabilities 79,854 Non-interest-bearing liabilities Shareholders' equity 834,927 TOTAL LIABILITIES & EQUITY Total Earning assets Cash & cash equivalents Allowance for loan & lease losses 76,037 614,628 148,101 72,198 834,927 TOTAL ASSETS Bank Hyfcal Statement of Comprehensive Income for the year ended 31st Dec 2018 Revenues: Interest income (-) interest expenses Net interest income Non interest income Total revenues 9,807 4,519 5,288 4,658 9,946 Expenses: Provision for loan losses Non-interest expense Total expenses Income before income taxes Income tax expense Net income Number of share outstanding are 72,198 units. 1,003 4,849 5,852 4,094 1,339 2,755 Calculate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts