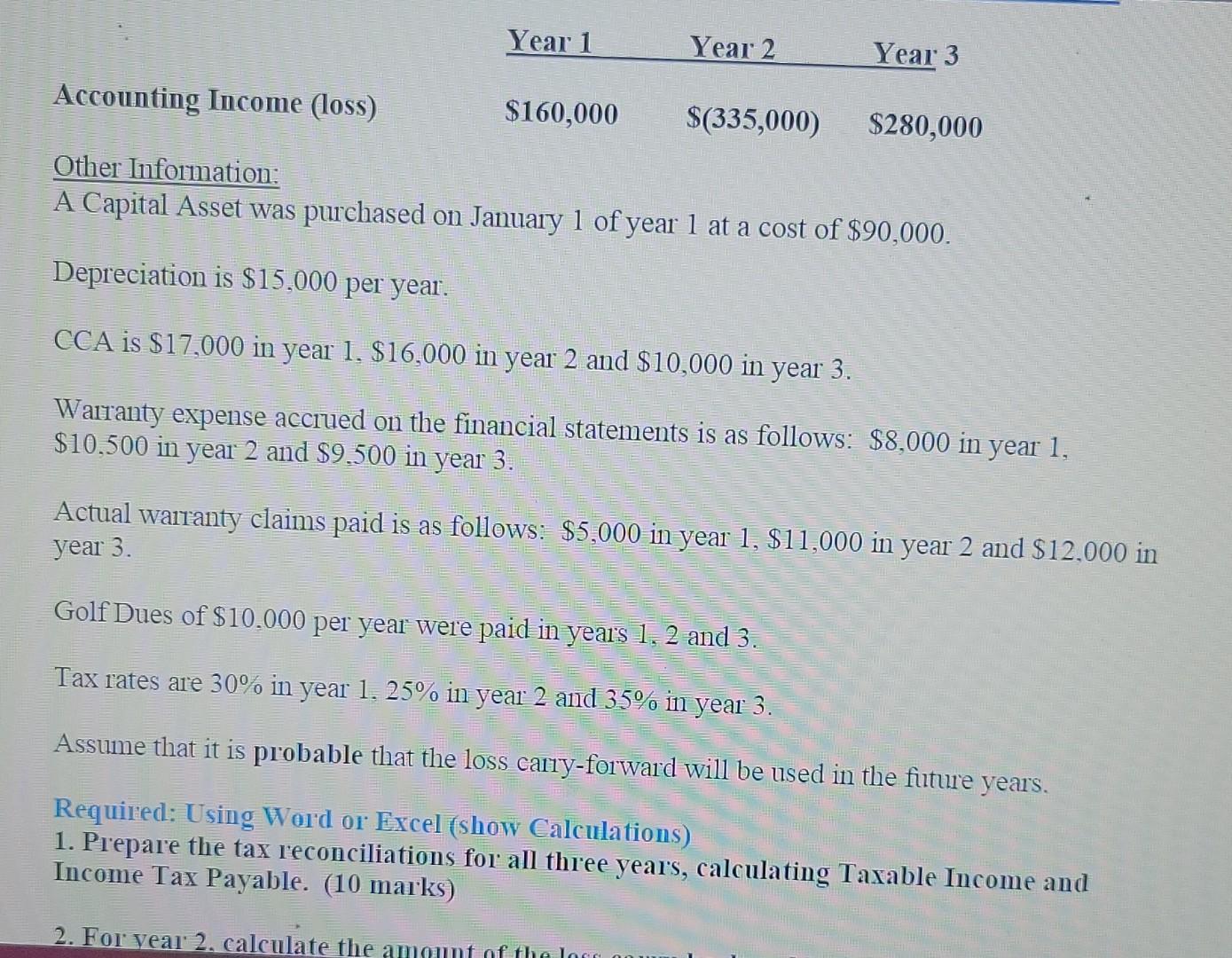

Question: right answer please this is the second time I am posting this question Year 1 Year 2 Year 3 Accounting Income (loss) $160,000 S(335,000) $280,000

right answer please this is the second time I am posting this question

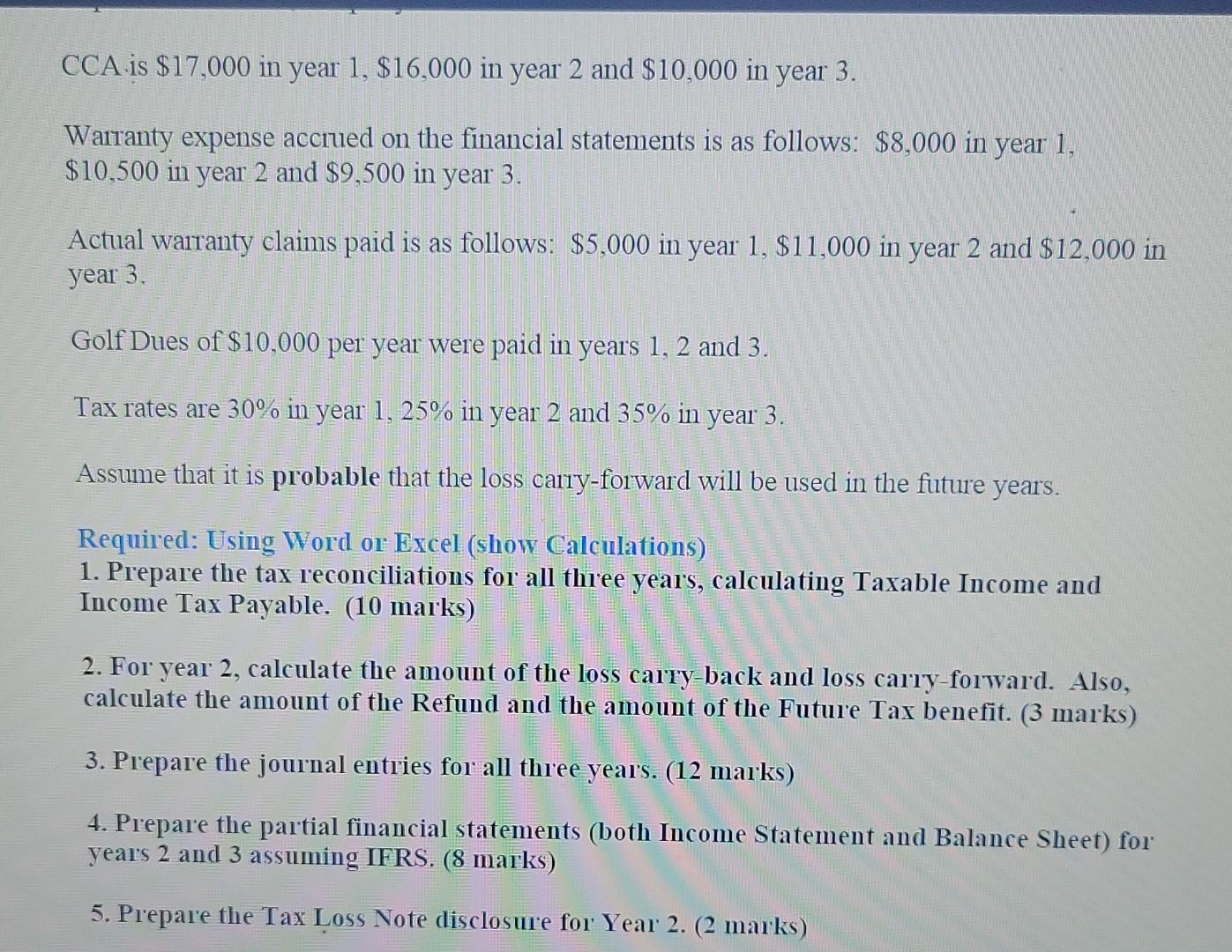

Year 1 Year 2 Year 3 Accounting Income (loss) $160,000 S(335,000) $280,000 Other Information: A Capital Asset was purchased on January 1 of year 1 at a cost of $90,000. Depreciation is $15,000 per year. CCA is $17,000 in year 1. $16,000 in year 2 and $10,000 in year 3. Warranty expense acciued on the financial statements is as follows: $8,000 in year 1, $10.500 in year 2 and $9.500 in year 3. Actual warranty claims paid is as follows: $5,000 in year 1, $11,000 in year 2 and $12.000 in year 3. Golf Dues of $10.000 per year were paid in years 1, 2 and 3. Tax rates are 30% in year 1. 25% in year 2 and 35% in year 3. Assume that it is probable that the loss carry-forward will be used in the future years. Required: Using Word or Excel (show Calculations) 1. Prepare the tax reconciliations for all three years, calculating Taxable income and Income Tax Payable. (10 marks) 2. For year 2. calculate the amount CCA is $17,000 in year 1, $16,000 in year 2 and $10,000 in year 3. Warranty expense accrued on the financial statements is as follows: $8,000 in year 1, $10,500 in year 2 and $9,500 in year 3. Actual warranty claims paid is as follows: $5,000 in year 1, $11,000 in year 2 and $12,000 in year 3. Golf Dues of $10,000 per year were paid in years 1, 2 and 3. Tax rates are 30% in year 1, 25% in year 2 and 35% in year 3. Assume that it is probable that the loss carry-forward will be used in the future years. Required: Using Word or Excel (show Calculations) 1. Prepare the tax reconciliations for all three years, calculating Taxable Income and Income Tax Payable. (10 marks) 2. For year 2, calculate the amount of the loss carry-back and loss carry-forward. Also, calculate the amount of the Refund and the amount of the Future Tax benefit. (3 marks) 3. Prepare the journal entries for all three years. (12 marks) 4. Prepare the partial financial statements (both Income Statement and Balance Sheet) for year's 2 and 3 assuming IFRS. (8 marks) 5. Prepare the Tax Loss Note disclosure for Year 2. (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts