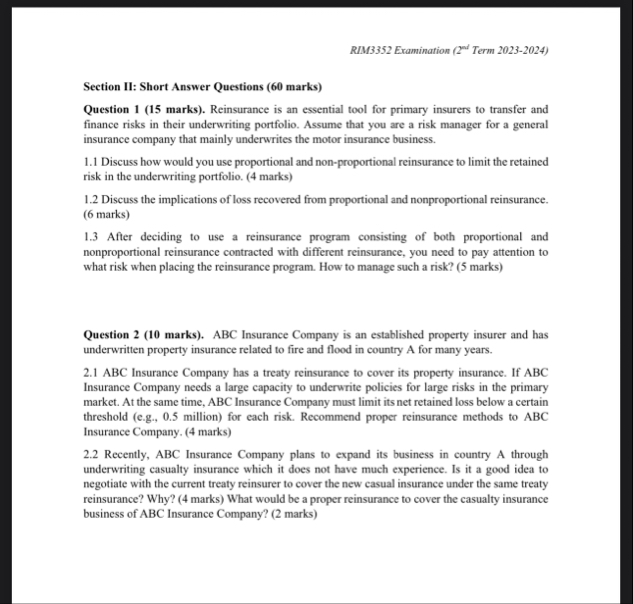

Question: RIM 3 3 5 2 Examination ( 2 2 e d Term 2 0 2 3 - 2 0 2 4 ) Section II: Short

RIM Examination Term

Section II: Short Answer Questions marks

Question marks Reinsurance is an essential tool for primary insurers to transfer and finance risks in their underwriting portfolio. Assume that you are a risk manager for a general insurance company that mainly underwrites the motor insurance business.

Discuss how would you use proportional and nonproportional reinsurance to limit the retained risk in the underwriting portfolio. marks

Discuss the implications of loss recovered from proportional and nonproportional reinsurance. marks

After deciding to use a reinsurance program consisting of both proportional and nonproportional reinsurance contracted with different reinsurance, you need to pay attention to what risk when placing the reinsurance program. How to manage such a risk? marks

Question marks ABC Insurance Company is an established property insurer and has underwritten property insurance related to fire and flood in country A for many years.

ABC Insurance Company has a treaty reinsurance to cover its property insurance. If ABC Insurance Company needs a large capacity to underwrite policies for large risks in the primary market. At the same time, ABC Insurance Company must limit its net retained loss below a certain threshold eg million for each risk. Recommend proper reinsurance methods to ABC Insurance Company. marks

Recently, ABC Insurance Company plans to expand its business in country A through underwriting casualty insurance which it does not have much experience. Is it a good idea to negotiate with the current treaty reinsurer to cover the new casual insurance under the same treaty reinsurance? Why? marks What would be a proper reinsurance to cover the casualty insurance business of ABC Insurance Company? marks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock