Question: Risk and Return (Answer All please!) Select the best answer Drop down list part - inflation premium, maturity risk premium, real rate of return, or

Risk and Return (Answer All please!)

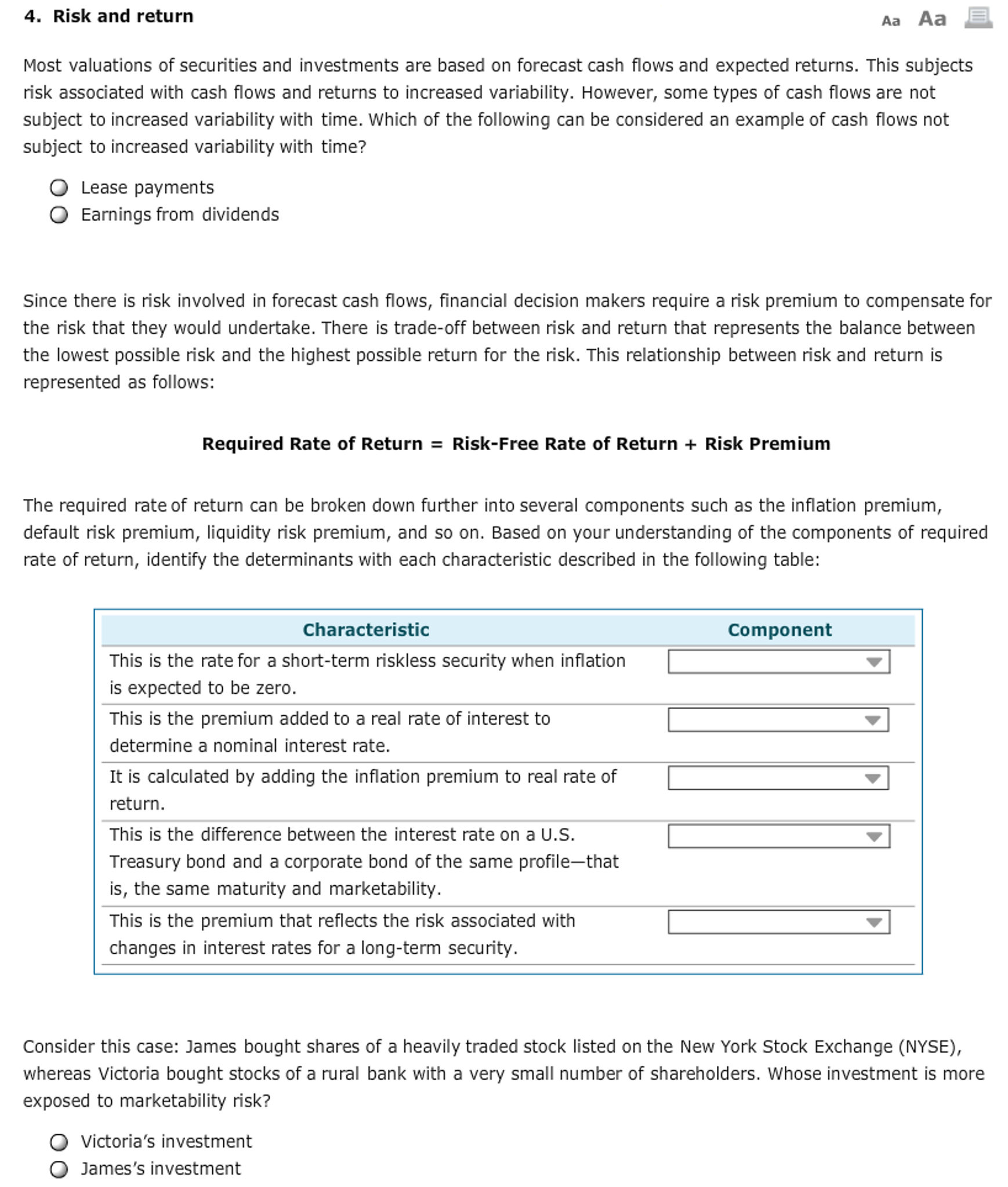

Select the best answer Drop down list part - inflation premium, maturity risk premium, real rate of return, or default risk premium - default risk premium, nominal risk-free rate, real rate of return, or Inflation premium - inflation premium, default risk premium, real rate of return, or nominal risk-free rate - nominal risk-free rate, maturity risk premium, real rate of return, or default risk premium - maturity risk premium, nominal risk-free rate, real rate of return, or inflation premium

Select the best answer

Thanks in advance!

4. Risk and return Aa Aa Most valuations of securities and investments are based on forecast cash flows and expected returns. This subjects risk associated with cash flows and returns to increased variability. However, some types of cash flows are not subject to increased variability with time. Which of the following can be considered an example of cash flows not subject to increased variability with time? O Lease payments O Earnings from dividends Since there is risk involved in forecast cash flows, financial decision makers require a risk premium to compensate for the risk that they would undertake. There is trade-off between risk and return that represents the balance between the lowest possible risk and the highest possible return for the risk. This relationship between risk and return is represented as follows Required Rate of Return Risk-Free Rate of Return Risk Premium The required rate of return can be broken down further into several components such as the inflation premium default risk premium, liquidity risk premium, and so on. Based on your understanding of the components of required rate of return, identify the determinants with each characteristic described in the following table: Characteristic Component This is the rate for a short-term riskless security when inflation is expected to be zero This is the premium added to a real rate of interest to determine a nominal interest rate It is calculated by adding the inflation premium to real rate of return This is the difference between the interest rate on a U.S Treasury bond and a corporate bond of the same profile-that is, the same maturity and marketability This is the premium that reflects the risk associated with changes in interest rates for a long-term security Consider this case: James bought shares of a heavily traded stock listed on the New York Stock Exchange (NYSE), whereas Victoria bought stocks of a rural bank with a very small number of shareholders. Whose investment is more exposed to marketability risk? O Victoria's investment O James's investment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts