Question: (Round to the nearest integer. No $ or ,needed when entering numbers. Don't leave any blank empty. I interpret empty blanks as you don't know

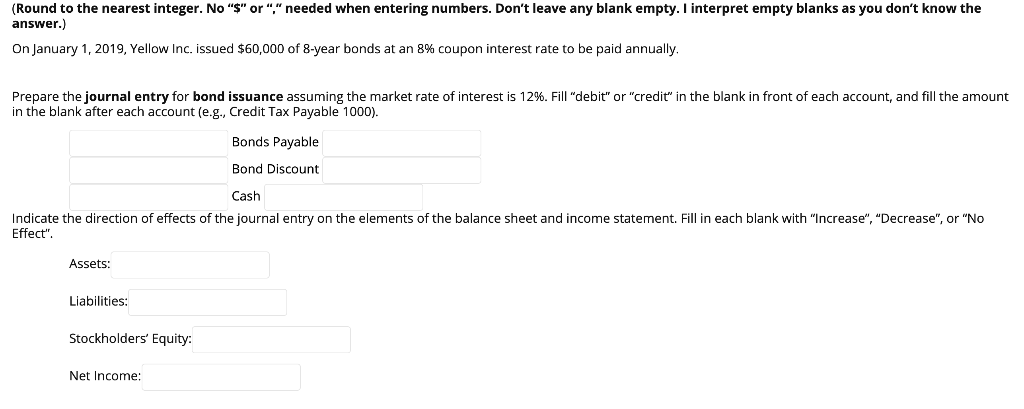

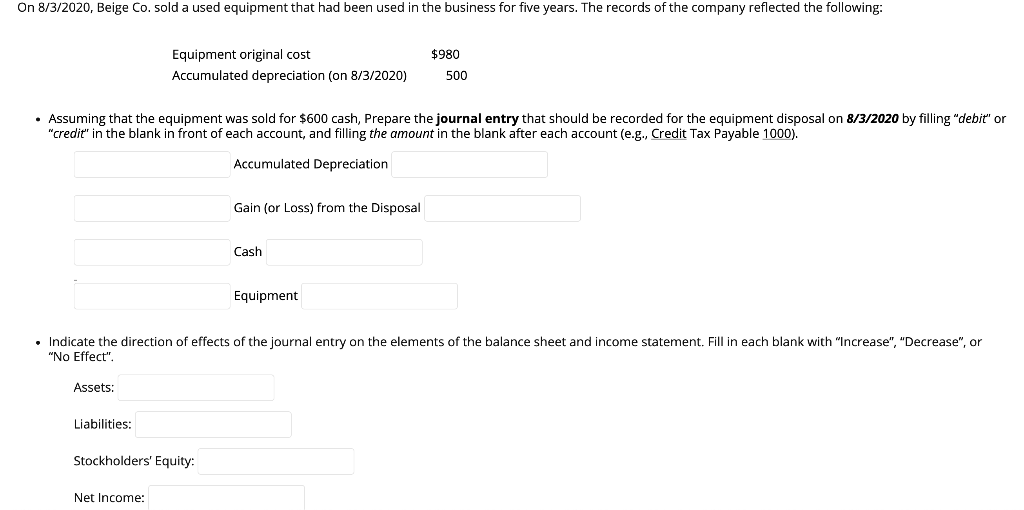

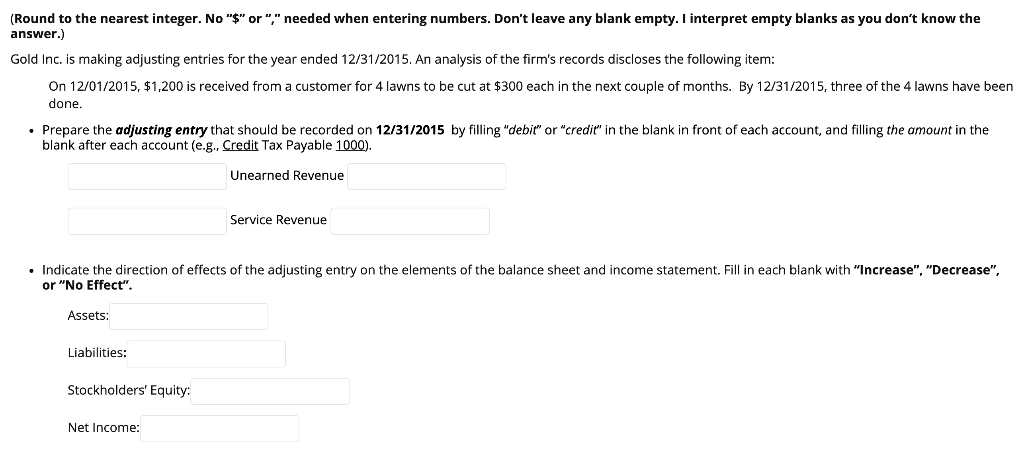

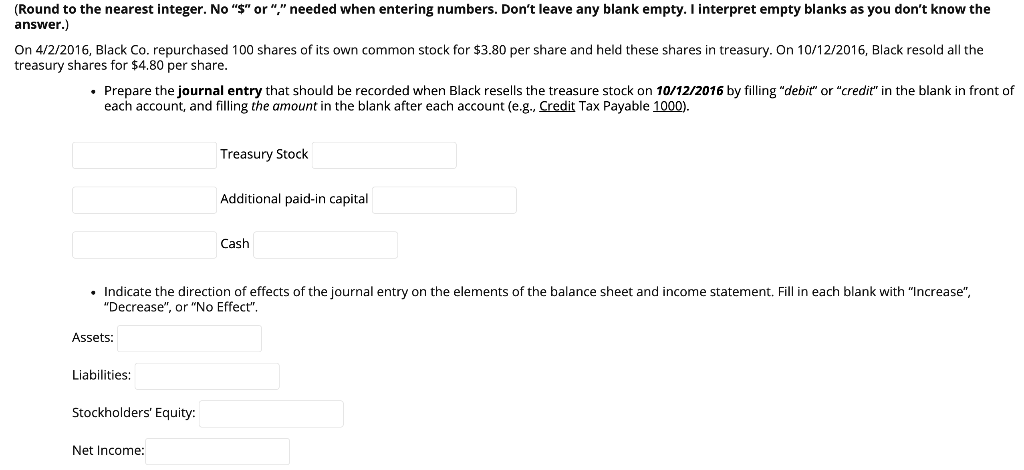

(Round to the nearest integer. No "$" or ","needed when entering numbers. Don't leave any blank empty. I interpret empty blanks as you don't know the answer.) On January 1, 2019, Yellow Inc. issued $60,000 of 8-year bonds at an 8% coupon interest rate to be paid annually. Prepare the journal entry for bond issuance assuming the market rate of interest is 12%. Fill "debit" or "credit" in the blank in front of each account, and fill the amount in the blank after each account (e.g., Credit Tax Payable 1000). Bonds Payable Bond Discount Cash Indicate the direction of effects of the journal entry on the elements of the balance sheet and income statement. Fill in each blank with "Increase", "Decrease", or "No Effect". Assets: Liabilities: Stockholders' Equity: Net Income: On 8/3/2020, Beige Co. sold a used equipment that had been used in the business for five years. The records of the company reflected the following: Equipment original cost Accumulated depreciation (on 8/3/2020) $980 500 Assuming that the equipment was sold for $600 cash, Prepare the journal entry that should be recorded for the equipment disposal on 8/3/2020 by filling "debit" or "credit" in the blank in front of each account, and filling the amount in the blank after each account(e.g., Credit Tax Payable 1000). Accumulated Depreciation Gain (or Loss) from the Disposal Cash Equipment Indicate the direction of effects of the journal entry on the elements of the balance sheet and income statement. Fill in each blank with "Increase", "Decrease", or "No Effect". Assets: Liabilities: Stockholders' Equity: Net Income: (Round to the nearest integer. No "$" or "" needed when entering numbers. Don't leave any blank empty. I interpret empty blanks as you don't know the answer.) Gold Inc. is making adjusting entries for the year ended 12/31/2015. An analysis of the firm's records discloses the following item: On 12/01/2015, $1,200 is received from a customer for 4 lawns to be cut at $300 each in the next couple of months. By 12/31/2015, three of the 4 lawns have been done. Prepare the adjusting entry that should be recorded on 12/31/2015 by filling "debit" or "credit" in the blank in front of each account, and filling the amount in the blank after each account (e.g., Credit Tax Payable 1000). Unearned Revenue Service Revenue Indicate the direction of effects of the adjusting entry on the elements of the balance sheet and income statement. Fill in each blank with "Increase", "Decrease", or "No Effect". Assets Liabilities: Stockholders' Equity: Net Income: (Round to the nearest integer. No "$" or ","needed when entering numbers. Don't leave any blank empty. I interpret empty blanks as you don't know the answer.) On 4/2/2016, Black Co. repurchased 100 shares of its own common stock for $3.80 per share and held these shares in treasury. On 10/12/2016, Black resold all the treasury shares for $4.80 per share. Prepare the journal entry that should be recorded when Black resells the treasure stock on 10/12/2016 by filling "debit" or "credit" in the blank in front of each account, and filling the amount in the blank after each account (e.g., Credit Tax Payable 1000). Treasury Stock Additional paid-in capital Cash Indicate the direction of effects of the journal entry on the elements of the balance sheet and income statement. Fill in each blank with "Increase", "Decrease", or "No Effect". Assets: Liabilities: Stockholders' Equity: Net Income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts