Question: (Round to the nearest integer. No $ or, needed when entering numbers. Don't leave any blank empty. I interpret empty blanks as you don't know

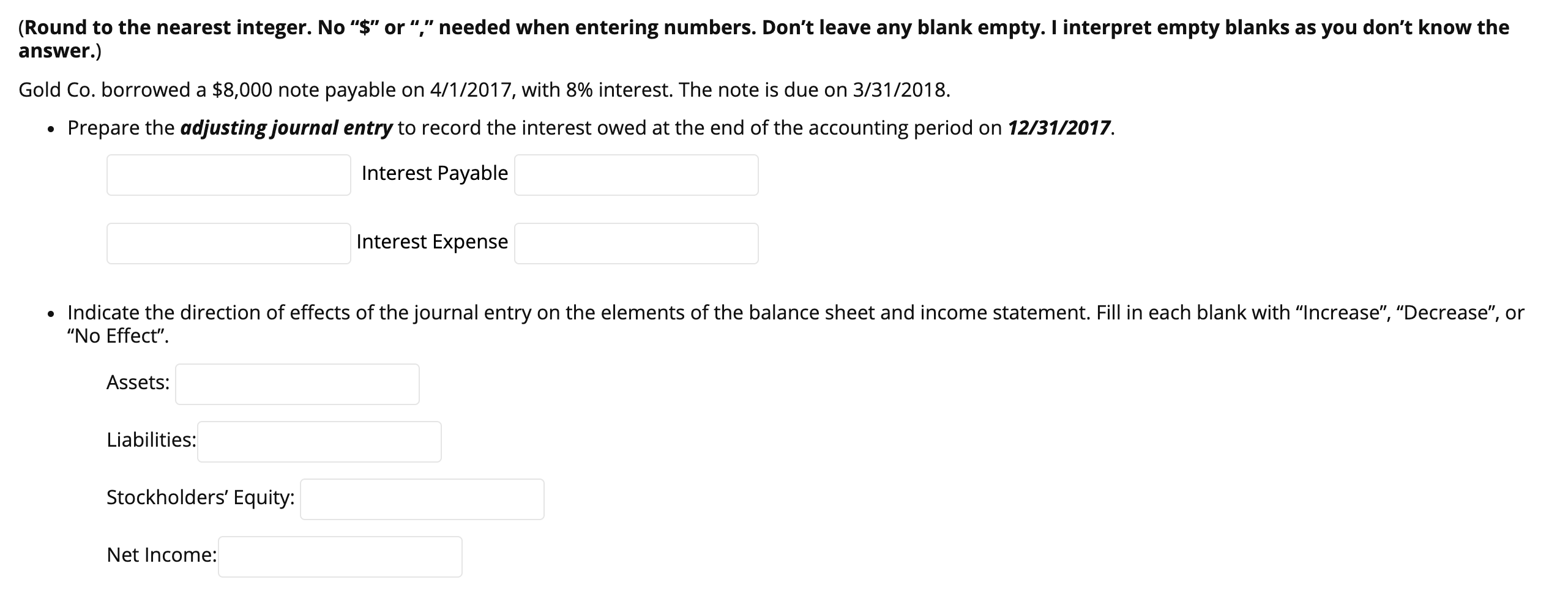

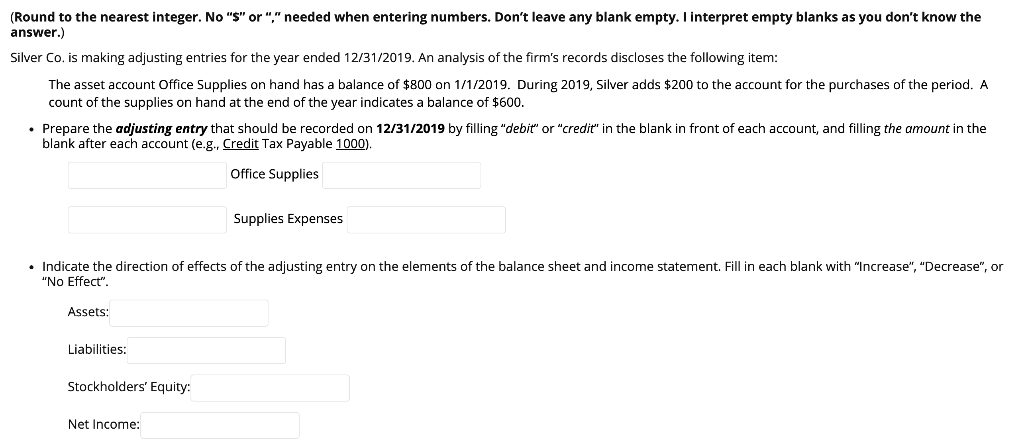

(Round to the nearest integer. No "$" or," needed when entering numbers. Don't leave any blank empty. I interpret empty blanks as you don't know the answer.) Gold Co. borrowed a $8,000 note payable on 4/1/2017, with 8% interest. The note is due on 3/31/2018. Prepare the adjusting journal entry to record the interest owed at the end of the accounting period on 12/31/2017. Interest Payable Interest Expense Indicate the direction of effects of the journal entry on the elements of the balance sheet and income statement. Fill in each blank with Increase, Decrease, or "No Effect". Assets: Liabilities: Stockholders' Equity: Net Income: (Round to the nearest integer. No "S" or ","needed when entering numbers. Don't leave any blank empty. I interpret empty blanks as you don't know the answer.) Silver Co. is making adjusting entries for the year ended 12/31/2019. An analysis of the firm's records discloses the following item: The asset account Office Supplies on hand has a balance of $800 on 1/1/2019. During 2019, Silver adds $200 to the account for the purchases of the period. A count of the supplies on hand at the end of the year indicates a balance of $600. Prepare the adjusting entry that should be recorded on 12/31/2019 by filling "debit" or "credit" in the blank in front of each account, and filling the amount in the blank after each account (e.g. Credit Tax Payable 1000). Office Supplies Supplies Expenses Indicate the direction of effects of the adjusting entry on the elements of the balance sheet and income statement. Fill in each blank with "Increase", "Decrease", or "No Effect". Assets: Liabilities: Stockholders' Equity: Net Income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts