Question: San Clemente Corporation, whose reporting currency is the Mark (M), establishes a foreign subsidiary, whose reporting currency is the Peseta (P). On January 1, Year

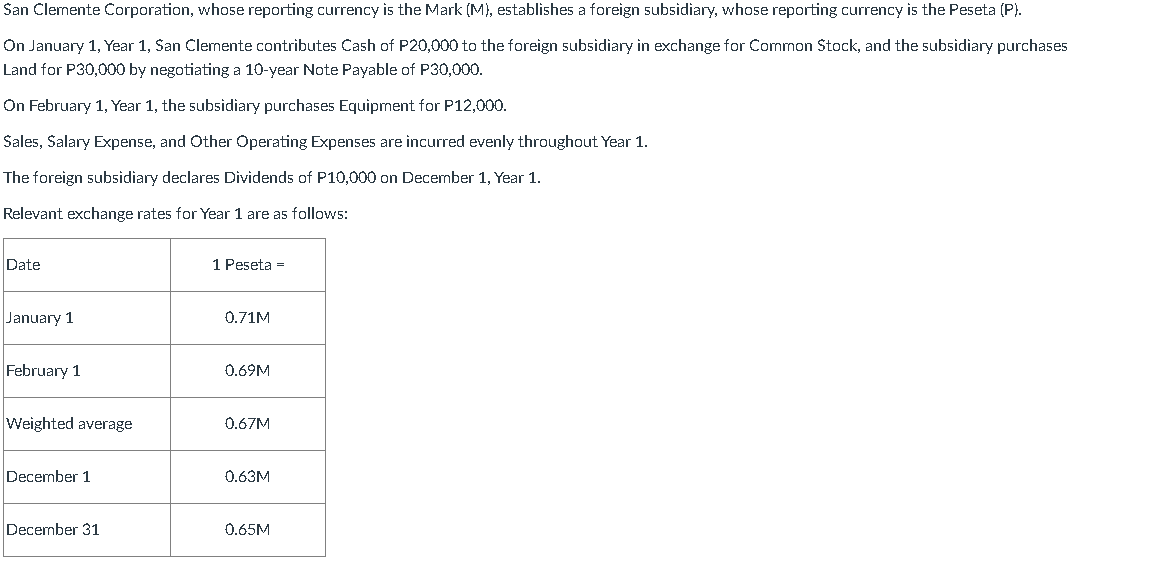

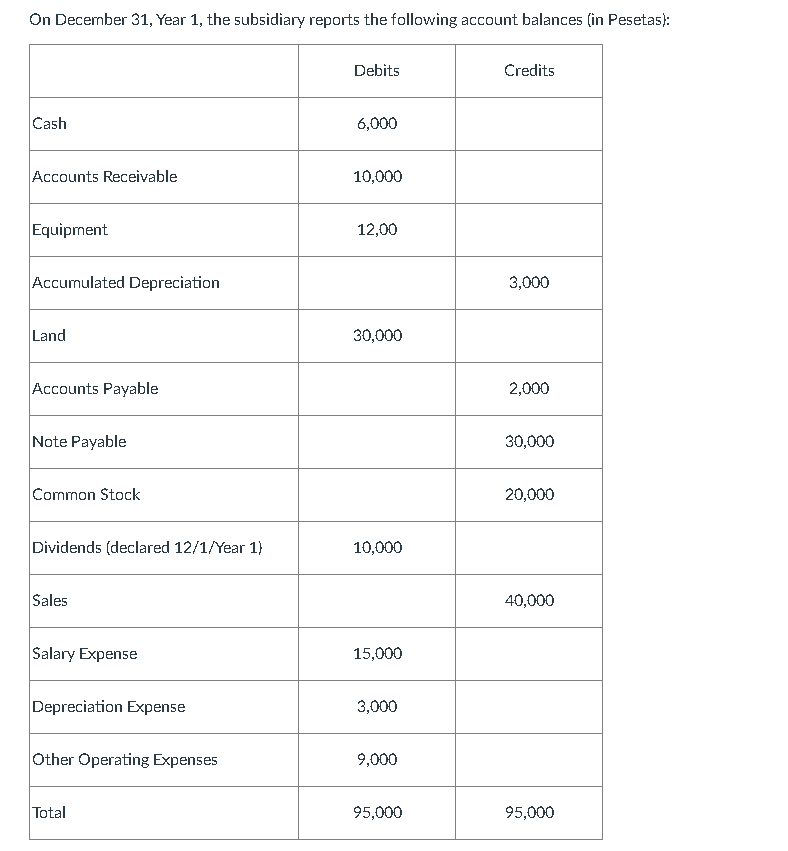

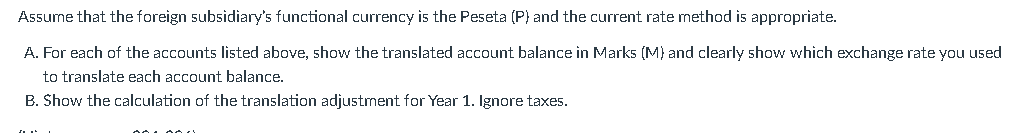

San Clemente Corporation, whose reporting currency is the Mark (M), establishes a foreign subsidiary, whose reporting currency is the Peseta (P). On January 1, Year 1, San Clemente contributes Cash of P20,000 to the foreign subsidiary in exchange for Common Stock, and the subsidiary purchases Land for P30,000 by negotiating a 10-year Note Payable of P30,000. On February 1, Year 1, the subsidiary purchases Equipment for P12,000. Sales, Salary Expense, and Other Operating Expenses are incurred evenly throughout Year 1. The foreign subsidiary declares Dividends of P10,000 on December 1, Year 1. Relevant exchange rates for Year 1 are as follows: On December 31, Year 1, the subsidiary reports the following account balances (in Pesetas): Assume that the foreign subsidiary's functional currency is the Peseta ( P ) and the current rate method is appropriate. A. For each of the accounts listed above, show the translated account balance in Marks ( M ) and clearly show which exchange rate you used to translate each account balance. B. Show the calculation of the translation adjustrnent for Year 1. Ignore taxes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts