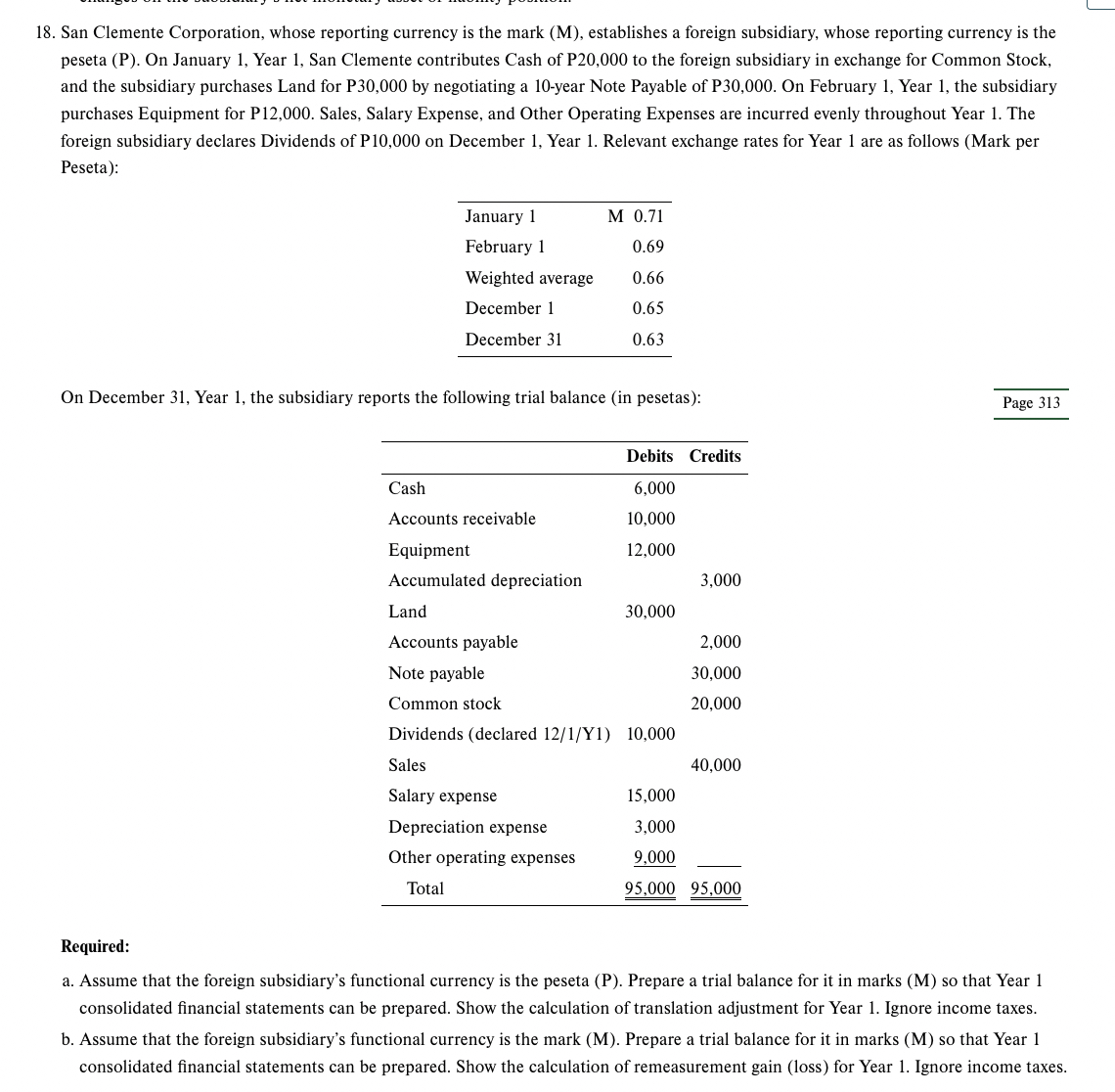

Question: San Clemente Corporation, whose reporting currency is the mark ( M ) , establishes a foreign subsidiary, whose reporting currency is the peseta ( P

San Clemente Corporation, whose reporting currency is the mark M establishes a foreign subsidiary, whose reporting currency is the

peseta P On January Year San Clemente contributes Cash of P to the foreign subsidiary in exchange for Common Stock,

and the subsidiary purchases Land for P by negotiating a year Note Payable of P On February Year the subsidiary

purchases Equipment for P Sales, Salary Expense, and Other Operating Expenses are incurred evenly throughout Year The

foreign subsidiary declares Dividends of P on December Year Relevant exchange rates for Year are as follows Mark per

Peseta:

On December Year the subsidiary reports the following trial balance in pesetas:

Required:

a Assume that the foreign subsidiary's functional currency is the peseta P Prepare a trial balance for it in marks M so that Year

consolidated financial statements can be prepared. Show the calculation of translation adjustment for Year Ignore income taxes.

b Assume that the foreign subsidiary's functional currency is the mark M Prepare a trial balance for it in marks M so that Year

consolidated financial statements can be prepared. Show the calculation of remeasurement gain loss for Year Ignore income taxes.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock