Question: Sarah and Benjamin Redding Case Study - 5 Personal Financial Planning 9th edition - Kaplan I would like to compare with other answers before submitting.

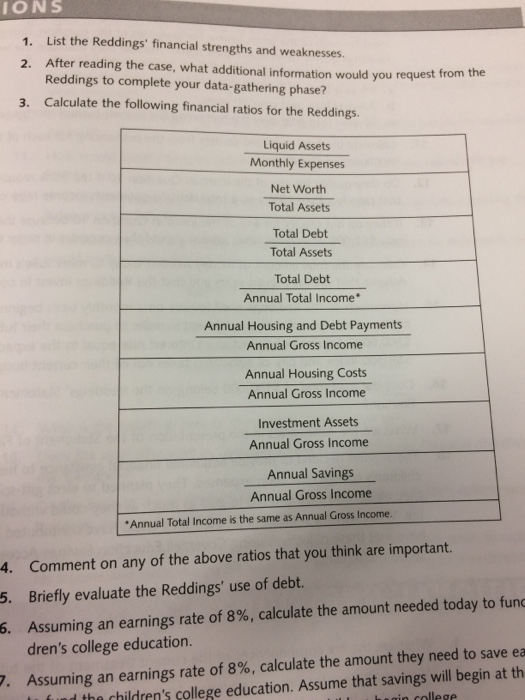

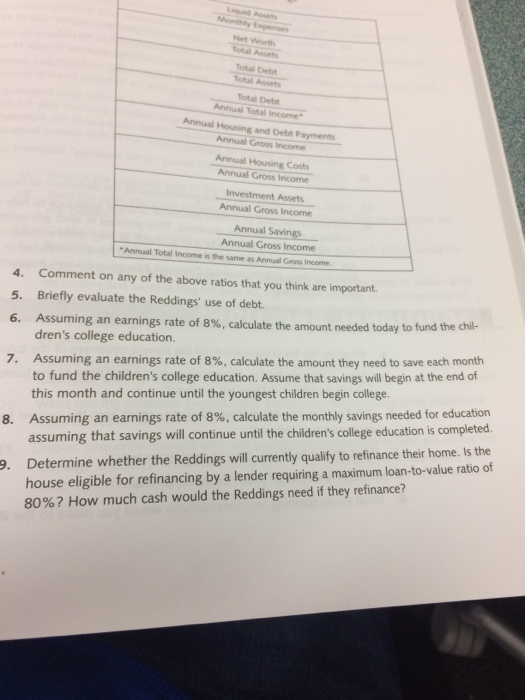

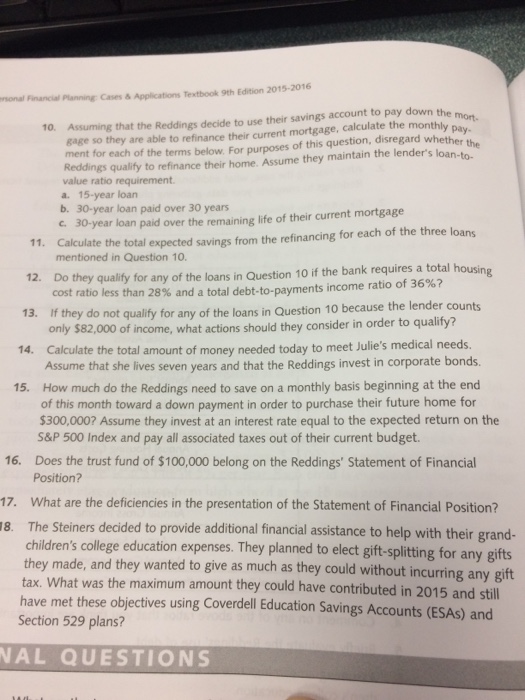

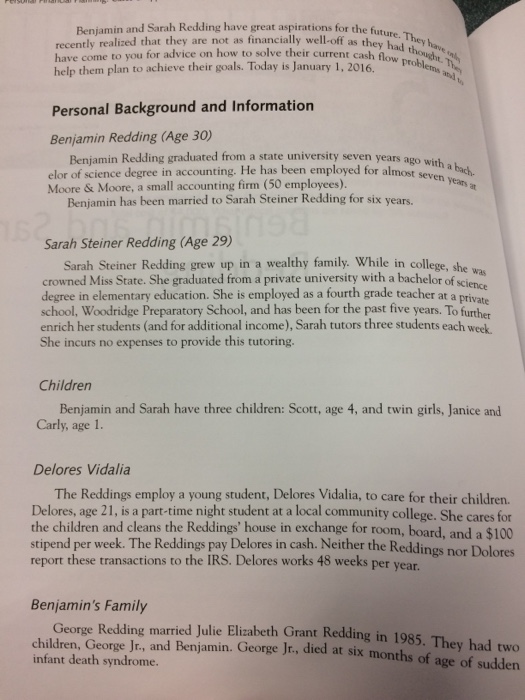

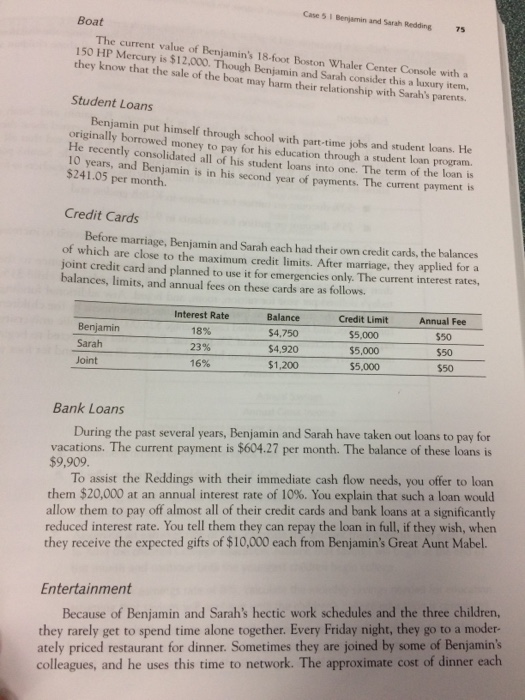

IONS 1. List the Reddings' financial strengths and weaknesses. 2. After reading the case, what additional information would you request from the Reddings to complete your data-gathering phase? 3. Calculate the following financial ratios for the Reddings. Liquid Assets Monthly Expenses Net Worth Total Assets Total Debt Total Assets Total Debt Annual Total Income Annual Housing and Debt Payments Annual Gross Income Annual Housing Costs Annual Gross Income Investment Assets Annual Gross Income Annual Savings Annual Gross Income "Annual Total Income is the same as Annual Gross Income 4. Comment on any of the above ratios that you think are important. 5. Briefly evaluate the Reddings' use of debt today to func Assuming an earnings rate of 8%, calculate the amount needed dren's college education. need to save ea Assuming an earnings rate of 8%, calculate the amount they begin at th tharhildrn's college education. Assume that savings will college IONS 1. List the Reddings' financial strengths and weaknesses. 2. After reading the case, what additional information would you request from the Reddings to complete your data-gathering phase? 3. Calculate the following financial ratios for the Reddings. Liquid Assets Monthly Expenses Net Worth Total Assets Total Debt Total Assets Total Debt Annual Total Income Annual Housing and Debt Payments Annual Gross Income Annual Housing Costs Annual Gross Income Investment Assets Annual Gross Income Annual Savings Annual Gross Income "Annual Total Income is the same as Annual Gross Income 4. Comment on any of the above ratios that you think are important. 5. Briefly evaluate the Reddings' use of debt today to func Assuming an earnings rate of 8%, calculate the amount needed dren's college education. need to save ea Assuming an earnings rate of 8%, calculate the amount they begin at th tharhildrn's college education. Assume that savings will college

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts