Question: Save & Exit Subm A gold-mining firm is concerned about short-term volatility in its revenues Gold currently sells for $1195 an ounce, but the price

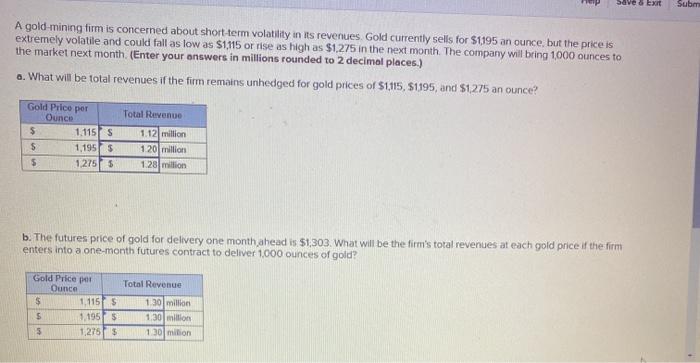

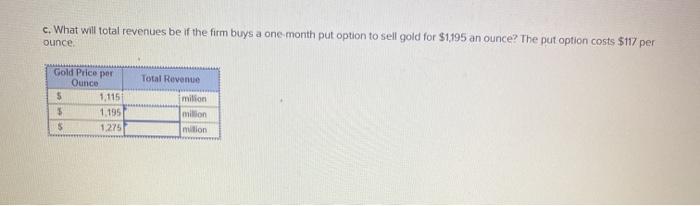

Save & Exit Subm A gold-mining firm is concerned about short-term volatility in its revenues Gold currently sells for $1195 an ounce, but the price is extremely volatile and could fall as low as $1115 or rise as high as $1.275 in the next month. The company will bring 1000 ounces to the market next month (Enter your answers in millions rounded to 2 decimal places.) a. What will be total revenues if the firm remains unhedged for gold prices of $1115, $1195, and S1275 an ounce? Gold Price per Total Revenue $ Ounce 1.115 s 1.1955 1.2753 5 1.121 million 120 million 1.28 million $ b. The futures price of gold for delivery one month ahead is $1,303. What will be the firm's total revenues at each gold price if the firm enters into a one-month futures contract to deliver 1000 ounces of gold? Gold Price per Ounce $ 1.115 5 $ 1.1955 3 1,2755 Total Revenue 1.30 million 1.30 million 130 milion c. What will total revenues be if the firm buys a one-month put option to sell gold for $1.195 an ounce? The put option costs $117 per ounce Gold Price per Ounce 5 1,115 3 1.195 S 1.225 Total Revenue milion million milion

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts