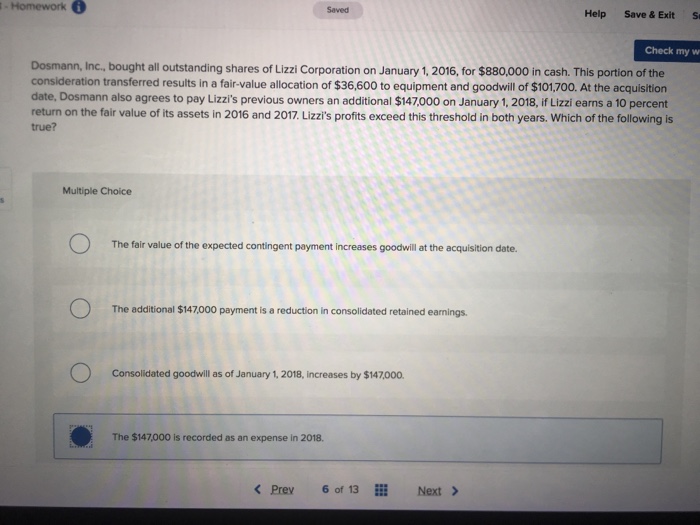

Question: Saved Help Save & Exit S Check my w Dosmann, Inc., bought all outstanding shares of Lizzi Corporation on January 1,2016, for $880,000 in cash.

Saved Help Save & Exit S Check my w Dosmann, Inc., bought all outstanding shares of Lizzi Corporation on January 1,2016, for $880,000 in cash. This portion of the consideration transferred results in a fair-value allocation of $36,600 to equipment and goodwill of $101.700. At the acquisition date, Dosmann also agrees to pay Lizzi's previous owners an additional $147000 on January 1, 2018, if Lizzi earns a 10 percent return on the fair value of its assets in 2016 and 2017. Lizzi's profits exceed this threshold in both years. Which of the following is true? Multiple Choice The fair value of the expected contingent payment increases goodwill at the acquisition date. The additional $147,000 payment is a reduction in consolidated retained earnings. Consolidated goodwill as of January 1, 2018, increases by $147000 The $147000 is recorded as an expense in 2018.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts