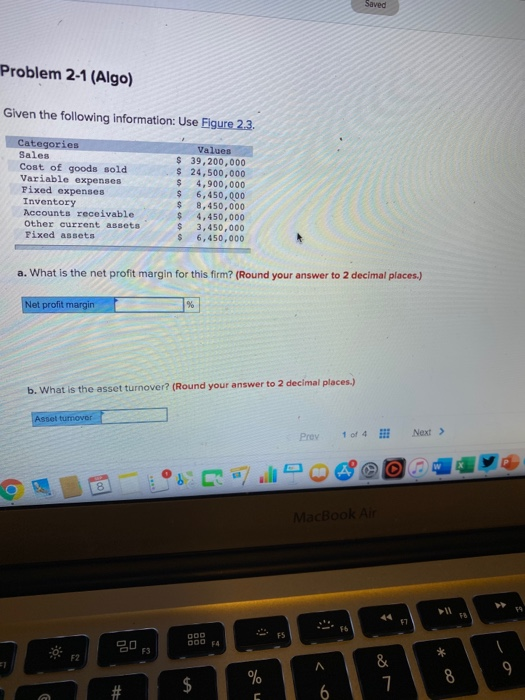

Question: Saved Problem 2-1 (Algo) Given the following information: Use Figure 2.3. Categories Sales Cost of goods sold Variable expenses Fixed expenses Inventory Accounts receivable Other

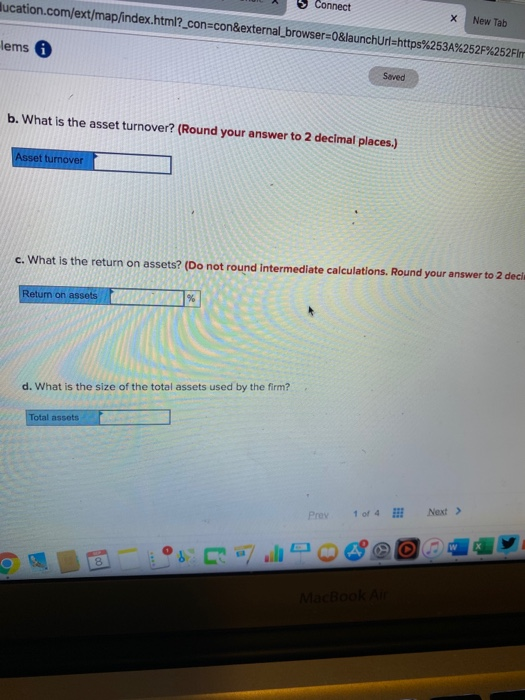

Saved Problem 2-1 (Algo) Given the following information: Use Figure 2.3. Categories Sales Cost of goods sold Variable expenses Fixed expenses Inventory Accounts receivable Other current assets Fixed assets Values $ 39,200,000 $ 24,500,000 $ 4,900,000 $ 6,450,000 $ 8,450,000 $ 4,450,000 $ 3,450,000 $ 6,450,000 a. What is the net profit margin for this firm? (Round your answer to 2 decimal places.) Net profit margin % b. What is the asset turnover? (Round your answer to 2 decimal places.) Assel turnover Prov 1 of 4 !!! Next > W 8 0 MacBook Air 11 ODD ES F3 F2 ET A % & 7 $ 9 8 6 Hucation.com/ext/map/index.html?_con=con&external_browser=0&launchurl=https%253A%252F%252Film Connect X New Tab lems Saved b. What is the asset turnover? (Round your answer to 2 decimal places.) Asset turnover c. What is the return on assets? (Do not round Intermediate calculations. Round your answer to 2 deci Return on assets % d. What is the size of the total assets used by the firm? Total assets Prov 1 of 4 Next > 8 MacBook Saved Problem 2-1 (Algo) Given the following information: Use Figure 2.3. Categories Sales Cost of goods sold Variable expenses Fixed expenses Inventory Accounts receivable Other current assets Fixed assets Values $ 39,200,000 $ 24,500,000 $ 4,900,000 $ 6,450,000 $ 8,450,000 $ 4,450,000 $ 3,450,000 $ 6,450,000 a. What is the net profit margin for this firm? (Round your answer to 2 decimal places.) Net profit margin % b. What is the asset turnover? (Round your answer to 2 decimal places.) Assel turnover Prov 1 of 4 !!! Next > W 8 0 MacBook Air 11 ODD ES F3 F2 ET A % & 7 $ 9 8 6 Hucation.com/ext/map/index.html?_con=con&external_browser=0&launchurl=https%253A%252F%252Film Connect X New Tab lems Saved b. What is the asset turnover? (Round your answer to 2 decimal places.) Asset turnover c. What is the return on assets? (Do not round Intermediate calculations. Round your answer to 2 deci Return on assets % d. What is the size of the total assets used by the firm? Total assets Prov 1 of 4 Next > 8 MacBook