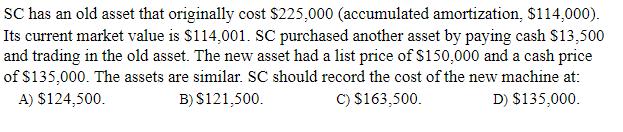

Question: SC has an old asset that originally cost $225,000 (accumulated amortization, $114,000). Its current market value is $114,001. SC purchased another asset by paying

SC has an old asset that originally cost $225,000 (accumulated amortization, $114,000). Its current market value is $114,001. SC purchased another asset by paying cash $13,500 and trading in the old asset. The new asset had a list price of $150,000 and a cash price of $135,000. The assets are similar. SC should record the cost of the new machine at: A) $124,500. B) $121,500. D) $135,000. C) $163,500.

Step by Step Solution

3.41 Rating (148 Votes )

There are 3 Steps involved in it

Answer A 124500 Explanation Cost Accumulated Amortization Book va... View full answer

Get step-by-step solutions from verified subject matter experts