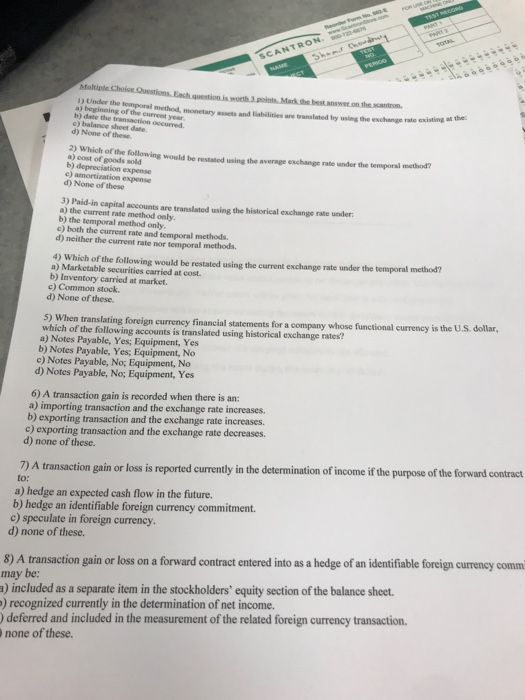

Question: SCANTRON. = 1) Under the rne cul method, monetary ascts and liabilitiles are tranalated by uwing the exchange rate exiating t date the tra d)

SCANTRON. = 1) Under the rne cul method, monetary ascts and liabilitiles are tranalated by uwing the exchange rate exiating t date the tra d) None of these. e) balance sheet date. occurred 2) Which of the would be restated using the average exchange rate under the tomporal method a) cost of goods solkd b) depreciation expense e) amortization expense d) None of these 3) Paid-in capital accounts are translated using the historical exchange rate under a) the current rate method only b) the temporal method only c) both the current rate and temporal methods. d) neither the current rate nor temporal methods. 4) Which of the following would be restated using the current exchange rate under the temporal method? Marketable securities carried at cost b) Inventory carried at market. c) Common stock d) None of these. 5) When translating foreign currency financial statements for a company whose functional currency is the U.S. dollar, which of the following accounts is translated using historical exchange rates? a) Notes Payable, Yes; Equipment, Yes b) Notes Payable, Yes; Equipment, No c) Notes Payable, No; Equipment, No d) Notes Payable, No; Equipment, Yes 6) A transaction gain is recorded when there is an: a) importing transaction and the exchange rate increases. b) exporting transaction and the exchange rate increases. c) exporting transaction and the exchange rate decreases. d) none of these. 7) A transaction gain or loss is reported currently in the determination of income if the purpose of the forward contract to: a) hedge an expected cash flow in the future b) hedge an identifiable foreign currency commitment. c) speculate in foreign currency. d) none of these. 8) A transaction gain or loss on a forward contract entered into as a hedge of an identifiable foreign currency comm may be: a) included as a separate item in the stockholders' equity section of the balance sheet. ) recognized currently in the determination of net income. deferred and included in the measurement of the related foreign currency transaction. none of these

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts