Question: Score: 0 of 1 pl HW Score: 18 4 of 10 (1 complete) Ques! P6-7 (book/static) Assigned Media Term structure of interest rates. The following

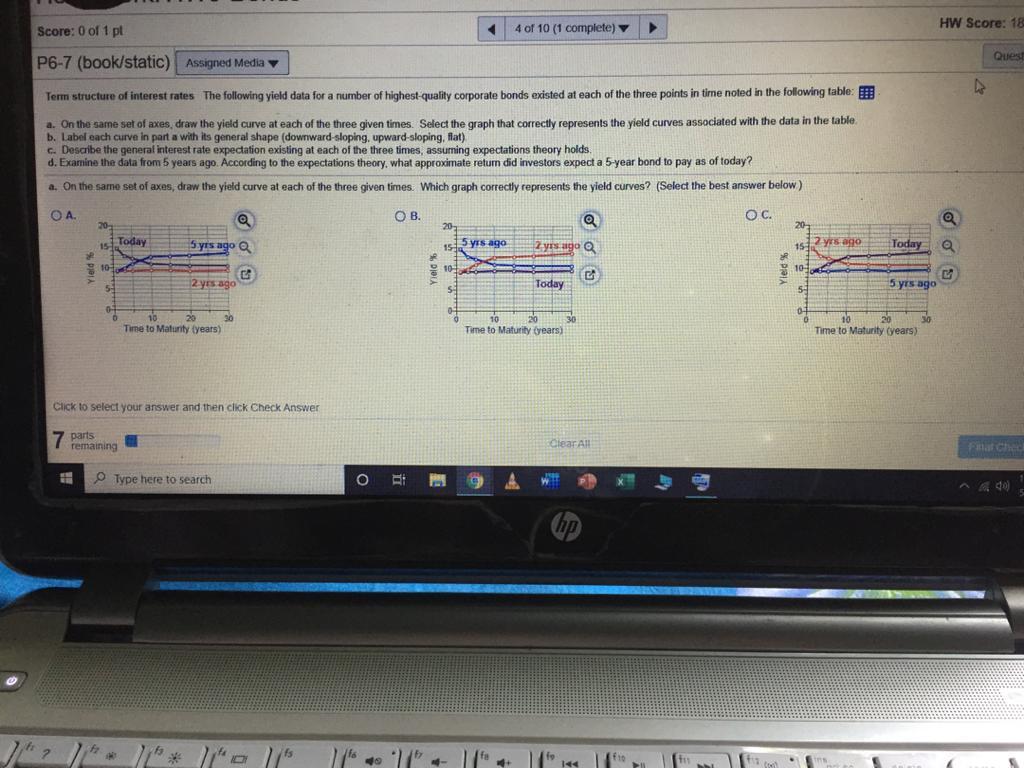

Score: 0 of 1 pl HW Score: 18 4 of 10 (1 complete) Ques! P6-7 (book/static) Assigned Media Term structure of interest rates. The following yield data for a number of highest-quality corporate bonds existed at each of the three points in time noted in the following table: a. On the same set of axes, draw the yield curve at each of the three given times. Select the graph that correctly represents the yield curves associated with the data in the table b. Label each curve in part a with its general shape (downward-sloping, upward-sloping, flat) Describe the general interest rate expectation existing at each of the three times, assuming expectations theory holds d. Examine the data from 5 years ago. According to the expectations theory. what approximate retum did investors expect a 5-year bond to pay as of today? a. On the same set of axes, draw the yield curve at each of the three given times. Which graph correctly represents the yield curves? (Select the best answer below) OA OB. Oc. Q 20 Today 20 15:15 yrs ago 20 15 2 yrs ago 5 yrs ago @ 2 yrs ago @ Today 100 101 10- 5 2 yrs ago Today 5 yrs ago 5 5 20 30 Time to Maturity Tyears) 10 20 Time to Maturity years) 10 30 30 Time to Maturity (years) Click to select your answer and then click Check Answer 7 parts remaining Clear All Type here to search O W: Chip 14 11 Score: 0 of 1 pl HW Score: 18 4 of 10 (1 complete) Ques! P6-7 (book/static) Assigned Media Term structure of interest rates. The following yield data for a number of highest-quality corporate bonds existed at each of the three points in time noted in the following table: a. On the same set of axes, draw the yield curve at each of the three given times. Select the graph that correctly represents the yield curves associated with the data in the table b. Label each curve in part a with its general shape (downward-sloping, upward-sloping, flat) Describe the general interest rate expectation existing at each of the three times, assuming expectations theory holds d. Examine the data from 5 years ago. According to the expectations theory. what approximate retum did investors expect a 5-year bond to pay as of today? a. On the same set of axes, draw the yield curve at each of the three given times. Which graph correctly represents the yield curves? (Select the best answer below) OA OB. Oc. Q 20 Today 20 15:15 yrs ago 20 15 2 yrs ago 5 yrs ago @ 2 yrs ago @ Today 100 101 10- 5 2 yrs ago Today 5 yrs ago 5 5 20 30 Time to Maturity Tyears) 10 20 Time to Maturity years) 10 30 30 Time to Maturity (years) Click to select your answer and then click Check Answer 7 parts remaining Clear All Type here to search O W: Chip 14 11

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts