Question: Scoth Corp is contemplating purchasing equipment that would increase sales revenues by $298,000 per year and cash operating expenses by $100,000 per year. The equipment

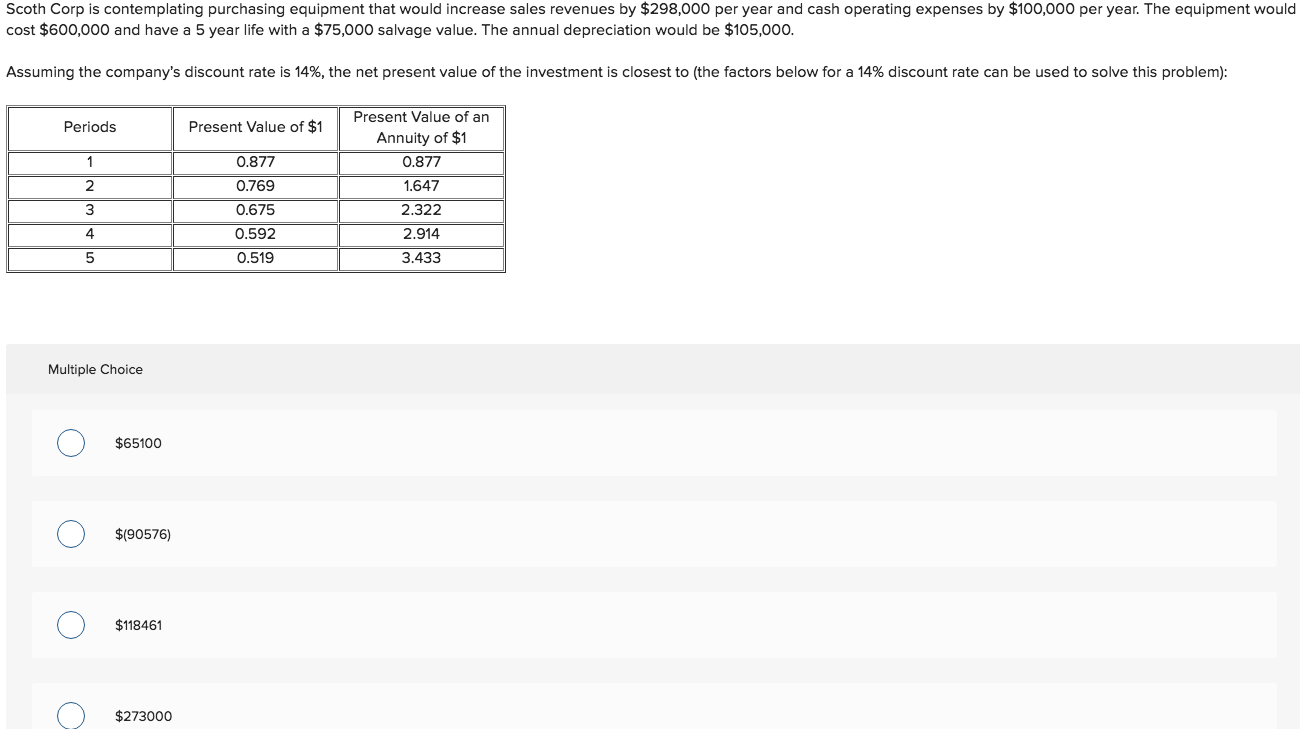

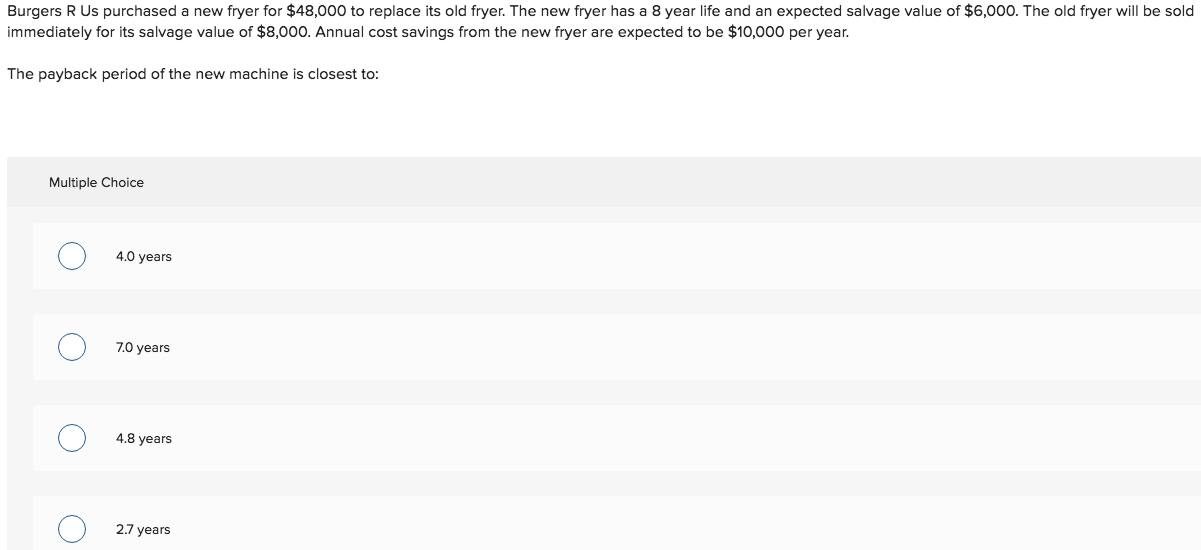

Scoth Corp is contemplating purchasing equipment that would increase sales revenues by $298,000 per year and cash operating expenses by $100,000 per year. The equipment would cost $600,000 and have a 5 year life with a $75,000 salvage value. The annual depreciation would be $105,000. Assuming the company's discount rate is 14%, the net present value of the investment is closest to the factors below for a 14% discount rate can be used to solve this problem): Periods Present Value of $1 0.877 0.769 0.675 0.592 0.519 Present Value of an Annuity of $1 0.877 1.647 2.322 2.914 3.433 4 Multiple Choice $65100 $(90576) $118461 $273000 Burgers R Us purchased a new fryer for $48,000 to replace its old fryer. The new fryer has a 8 year life and an expected salvage value of $6,000. The old fryer will be sold immediately for its salvage value of $8,000. Annual cost savings from the new fryer are expected to be $10,000 per year. The payback period of the new machine is closest to: Multiple Choice 0 4.0 years 0 7.0 years 0 4.8 years 4.8 years 0 2.7 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts