Question: Scoth Corp is contemplating purchasing equipment that would increase sales revenues by $288,000 per year and cash operating expenses by $140,000 per year. The equipment

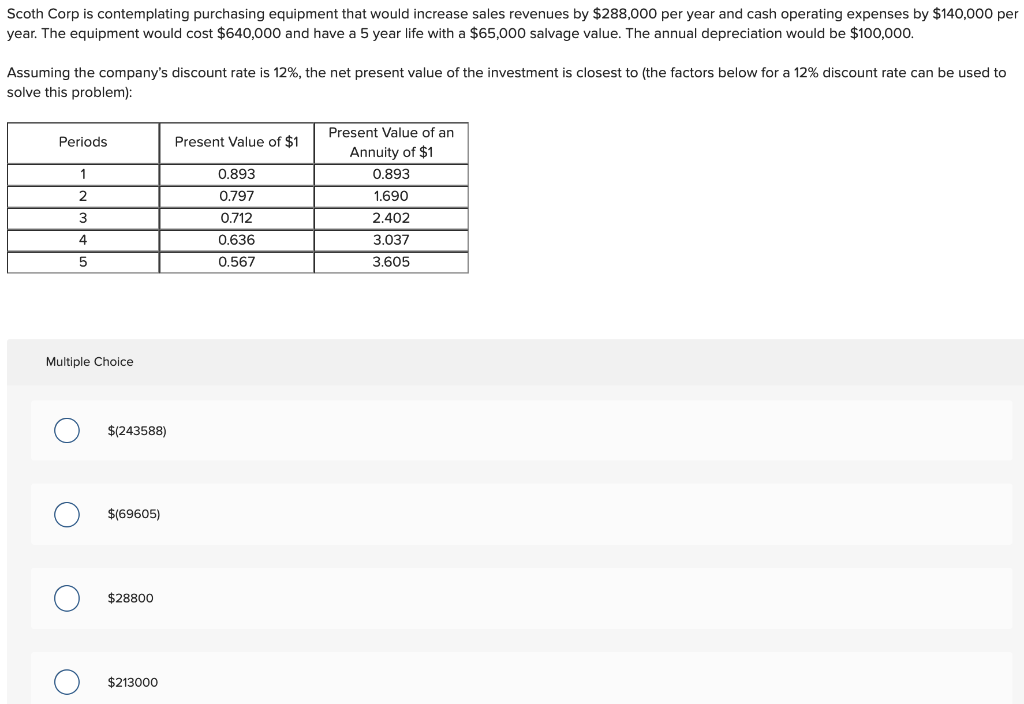

Scoth Corp is contemplating purchasing equipment that would increase sales revenues by $288,000 per year and cash operating expenses by $140,000 per year. The equipment would cost $640,000 and have a 5 year life with a $65,000 salvage value. The annual depreciation would be $100,000. Assuming the company's discount rate is 12%, the net present value of the investment is closest to the factors below for a 12% discount rate can be used to solve this problem): Periods Present Value of $1 Present Value of an Annuity of $1 0.893 1.690 2.402 3.037 3.605 3 0.893 0.797 0.712 0.636 0.567 T Multiple Choice $(243588) $(69605) $28800 $213000

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock