Question: Scoth Corp is contemplating purchasing equipment that would increase sales revenues by $320,000 per year and cash operating expenses by $110,000 per year. The equipment

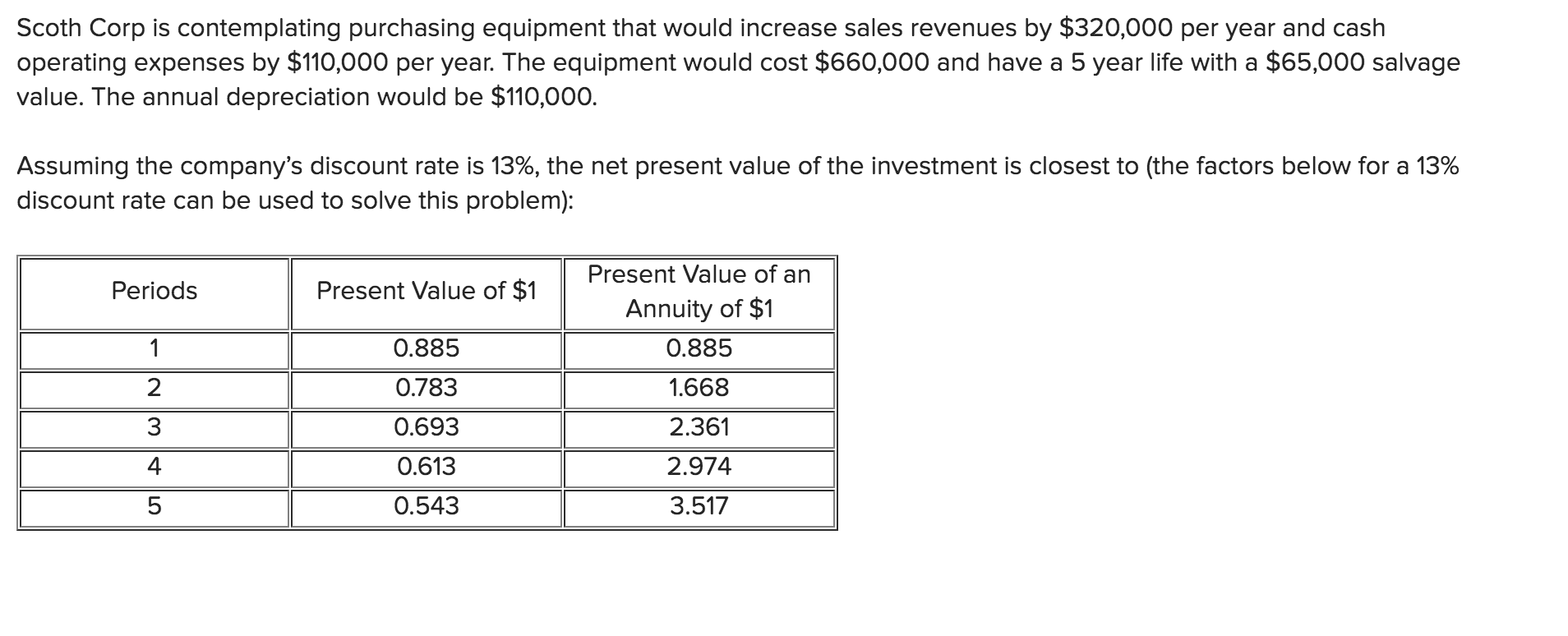

Scoth Corp is contemplating purchasing equipment that would increase sales revenues by $320,000 per year and cash operating expenses by $110,000 per year. The equipment would cost $660,000 and have a 5 year life with a $65,000 salvage value. The annual depreciation would be $110,000. Assuming the company's discount rate is 13%, the net present value of the investment is closest to the factors below for a 13% discount rate can be used to solve this problem): Periods Present Value of $1 Present Value of an Annuity of $1 0.885 0.885 0.783 1.668 0.693 2.361 Nm - 10 0.613 2.974 0.543 3.517

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts