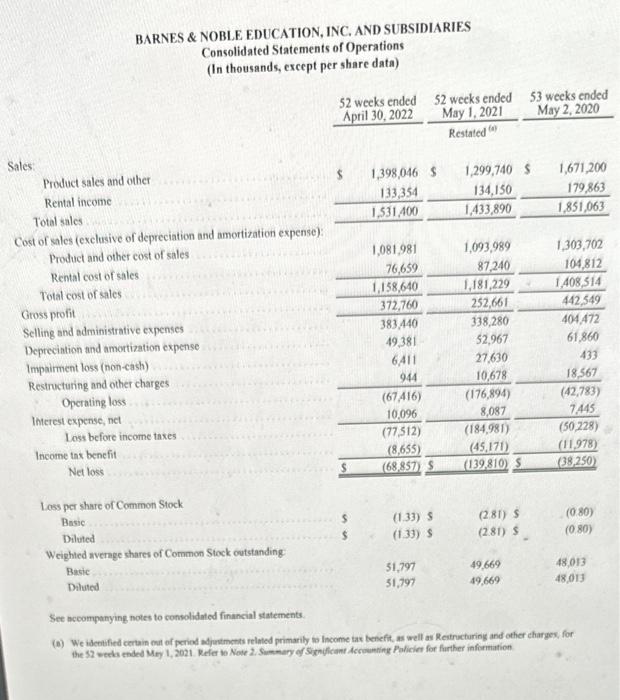

Question: Scroll down on the left-hand bookmarks until you get to consolidated statements of operations. Has Barnes & Noble been profitable in the last three years?

BARNES \& NOBLE EDUCATION, INC.AND SUBSIDIARIES Consolidated Statements of Operations (In thousands, except per share data) Sales Product sales and other Rental income Total sales Cost of sales (exclusive of depreciation and amortization expense): Product and other cost of sales Rental cost of sales Total cost of sales Gross profit Selling and administrative expenses Depreciation and amortization expense Impairment loss (non-cash) Restructuring and other charges Inerest expense, net Loss before income taxes \begin{tabular}{rrr} 1,081,981 & 1,093,989 & 1,303,702 \\ 76,659 & 87,240 & 104,812 \\ \hline 1,158,640 & 1,181,229 & 1,408,514 \\ \hline 372,760 & 252,661 & 442,549 \\ \hline 383,440 & 338,280 & 404,472 \\ 49,381 & 52,967 & 61,860 \\ 6,411 & 27,630 & 433 \\ 944 & 10,678 & 18,567 \\ \hline(67,416) & (176,894) & (42,783) \\ 10,096 & 8,087 \\ \hline(77,512) & (184,981) & 7,445 \\ \hline(8,655) & (50,228) \\ \hline \end{tabular} Income tax benefit Net loss Lass per share of Common Stock (2.81) S (080) Basic (1.33) 5 (0.80) Diluted (i.33) $ (2.81) 5 Weighted avenge shares of Common Stock outstanding Busic Diluted 51,79751,79749,66949,66948,01348,013 See accompanying notes to consolidated finuncial statements

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts