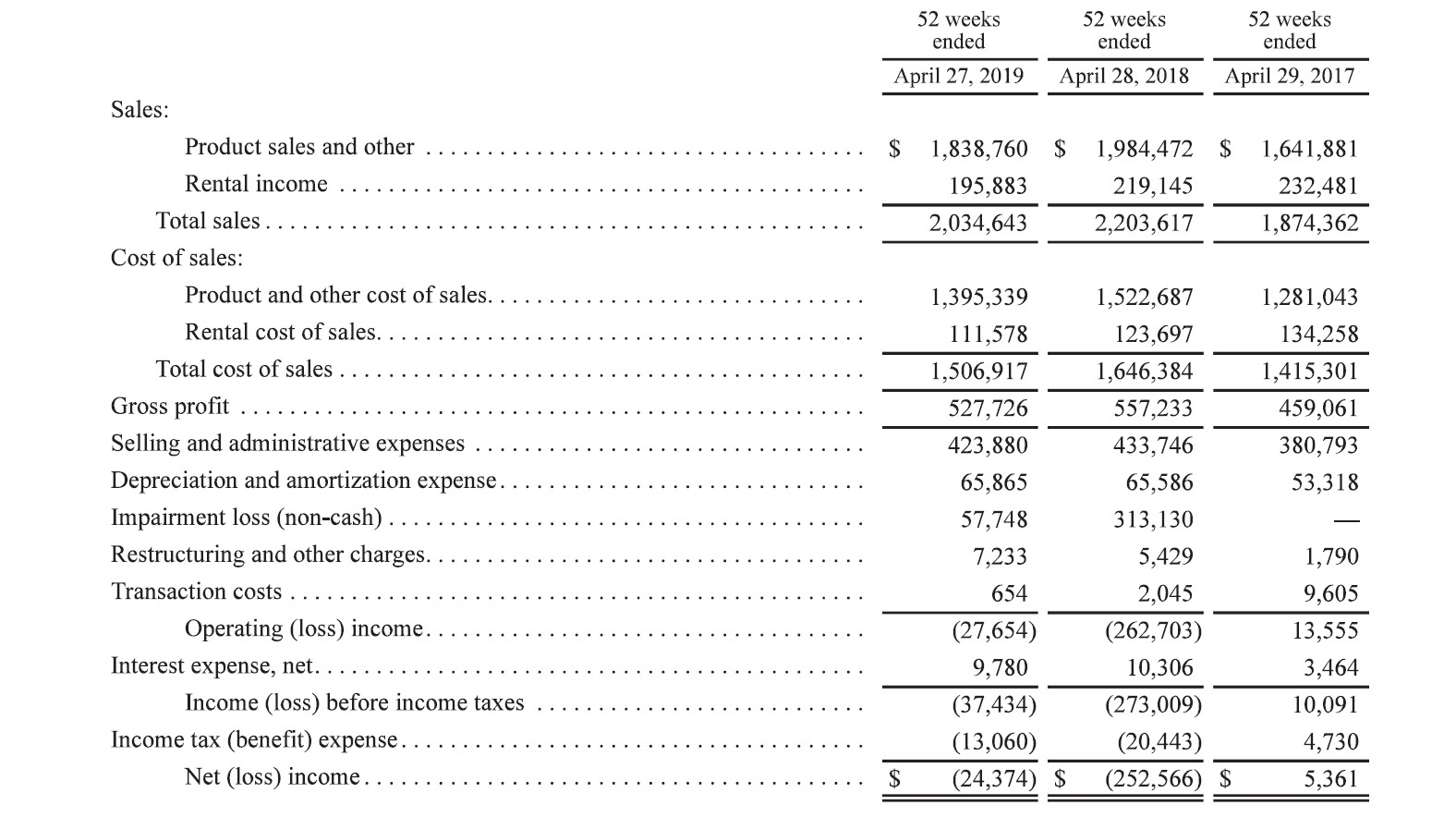

Question: Scroll down on the left-hand bookmarks until you get to Consolidated Statements of Operations. Has Barnes & Noble been profitable in the last three years?

Scroll down on the left-hand bookmarks until you get to Consolidated Statements of Operations. Has Barnes & Noble been profitable in the last three years? Click on Consolidated Balance Sheet. What is the ratio of Total Current and Non-Current Liabilities to Total Assets for the past two periods? Anything over 70 percent is considered too high. How does Barnes & Noble look?

Scroll down on the left-hand bookmarks until you get to Consolidated Statements of Operations. Has Barnes & Noble been profitable in the last three years? Click on Consolidated Balance Sheet. What is the ratio of Total Current and Non-Current Liabilities to Total Assets for the past two periods? Anything over 70 percent is considered too high. How does Barnes & Noble look?

52 weeks ended April 27, 2019 52 weeks ended April 28, 2018 52 weeks ended April 29, 2017 $ .............. 1,838,760 $ 195,883 2,034,643 1,984,472 $ 219,145 2,203,617 1,641,881 232,481 1,874,362 Total sales................................................. Sales: Product sales and other ....... Rental income ... Total sales ...... Cost of sales: Product and other cost of sales............ Rental cost of sales....... Total cost of sales ................. Gross profit ................ .......... Selling and administrative expenses ......... Depreciation and amortization expense. Impairment loss (non-cash)............ Restructuring and other charges. ............ Transaction costs ........ Operating (loss) income............. Interest expense, net.......... Income (loss) before income taxes ......... Income tax (benefit) expense..... Net (loss) income........... 1,281,043 134,258 1,415,301 459,061 380,793 53,318 1,395,339 111,578 1,506,917 527,726 423,880 65,865 57,748 7,233 654 (27,654) 9,780 (37,434) (13,060) (24,374) $ 1,522,687 123,697 1,646,384 557,233 433,746 65,586 313,130 5,429 2,045 (262,703) 10,306 (273,009) (20,443) (252,566) $ 1,790 9,605 13,555 3,464 10,091 4,730 5,361

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts