Question: 5. Scroll down on the left-hand bookmarks until you get to Consolidated Statements of Operations. Has Barnes & Noble been profitable in the last three

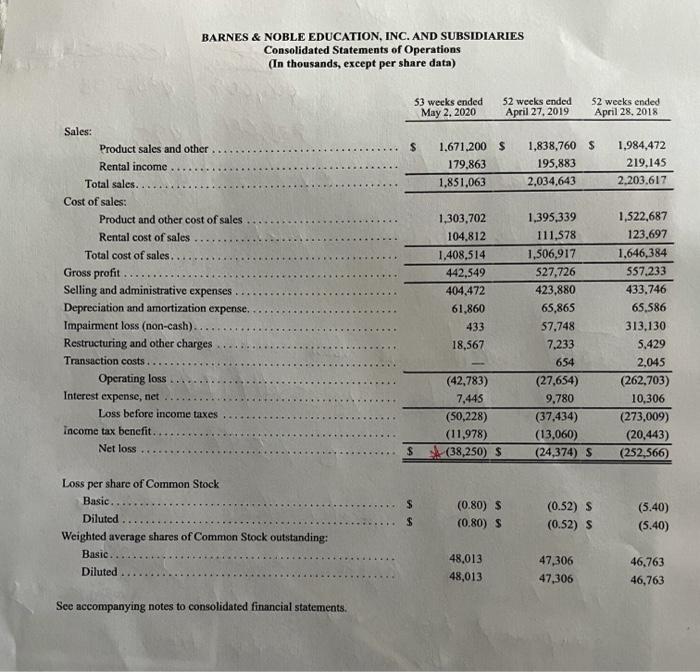

5. Scroll down on the left-hand bookmarks until you get to "Consolidated Statements of Operations." Has Barnes & Noble been profitable in the last three years? BARNES & NOBLE EDUCATION, INC. AND SUBSIDIARIES Consolidated Statements of Operations (In thousands, except per share data) 53 weeks ended May 2, 2020 52 weeks ended April 27, 2019 52 weeks ended April 28, 2018 $ 1.671.200 $ 179,863 1,851,063 1,838,760 $ 195,883 2,034,643 1,984,472 219.145 2,203.617 Sales: Product sales and other. Rental income Total sales.. Cost of sales: Product and other cost of sales Rental cost of sales Total cost of sales. Gross profit Selling and administrative expenses Depreciation and amortization expense. Impairment loss (non-cash). Restructuring and other charges Transaction costs Operating loss Interest expense, net Loss before income taxes Income tax benefit. Net loss 1,303,702 104,812 1.408,514 442,549 404,472 61,860 433 18,567 1,395,339 111,578 1,506,917 527,726 423,880 65,865 57.748 7.233 654 (27,654) 9.780 (37,434) (13,060) (24,374) S 1,522,687 123,697 1,646,384 557.233 433.746 65,586 313,130 5,429 2.045 (262,703) 10,306 (273,009) (20,443) (252,566) (42,783) 7,445 (50,228) (11,978) $(38,250) S $ $ Loss per share of Common Stock Basic. Diluted Weighted average shares of Common Stock outstanding: Basic.. Diluted (0.80) $ (0.80) S (0.52) S (0.52) S (5.40) (5.40) 48,013 48,013 47,306 47,306 46,763 46,763 See accompanying notes to consolidated financial statements

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts