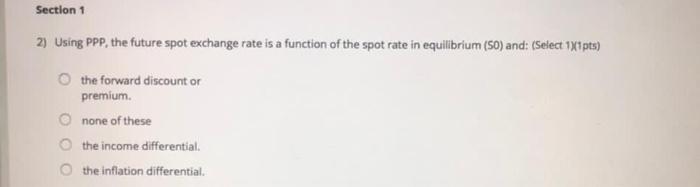

Question: Section 1 2) Using PPP, the future spot exchange rate is a function of the spot rate in equilibrium (SO) and (Select 1x1 pts) the

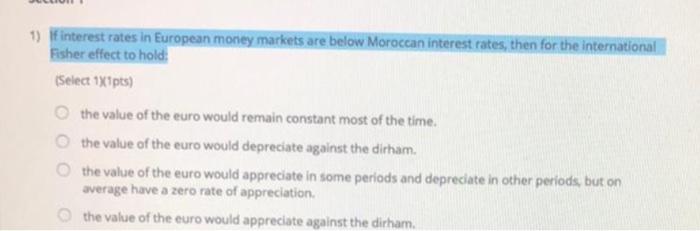

Section 1 2) Using PPP, the future spot exchange rate is a function of the spot rate in equilibrium (SO) and (Select 1x1 pts) the forward discount or premium none of these the income differential the Inflation differential 1) interest rates in European money markets are below Moroccan interest rates, then for the international Fisher effect to hold: Select 1x pts the value of the euro would remain constant most of the time. the value of the euro would depreciate against the dirham. the value of the euro would appreciate in some periods and depreciate in other periods, but on average have a zero rate of appreciation. the value of the euro would appreciate against the dirham

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts