Question: SECTION 1 Max Laboratories Inc. has been operating for over thirty years producing medications and food for pets and farm animals. Due to new growth

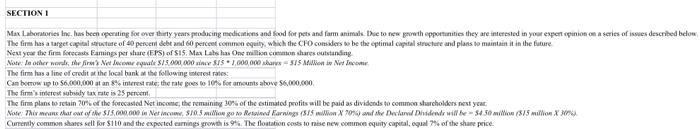

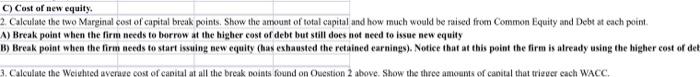

SECTION 1 Max Laboratories Inc. has been operating for over thirty years producing medications and food for pets and farm animals. Due to new growth opportunities they are interested in your expert opinion on a series of issues described below The firm has a target capital structure of 40 persen debt and 60 percent comme equity, which the CFO.comsiders to be the optimal capital structure and plans to maintain it in the future Next year the firm forecasts Faming per share (EPS) of S15, Me Lalls das One million common shares outstanding Now leather words, the fire Nedale 375.000000 315 * 1,000,000 bars - 315 MilliNed Income The firm us a line of credit at the local bank at the following interest rates Can borrow up to 56,000,000 at an interest rate the tale goes to 10 for amounts above 56.000.000 The firm interest by tax rate is 25 percent The firm plans to retain 20% of the forecasted Net Income, the remaining 10% of the estimated profits will be paid as dividends to common shareholders next year Note: Thir memaroor of 515.000.000 Net in $10.5 i go no Resid Barnings (515 willion X 70%) and the Declav Dhedende will be - 5450 milion 515 million X Currently common shares sell for $10 and the exported earnings growth is 95. The flotation costs to nese new comme equity capital, equal 7% of the share price C) Cost of new equity. 2. Calculate the two Marginal cost of capital break points. Show the amount of total capital and how much would be raised from Common Equity and Debt at each point A) Break point when the firm needs to borrow at the higher cost of debt but still does not need to issue new equity B) Break point when the firm needs to start issuing new equity (has exhausted the retained earnings). Notice that at this point the firm is already using the higher cost of det 3. Calculate the weighted average cost of capital at all the break points found on Ouestion 2 above. Show the three amounts of capital that triever each WACC. SECTION 1 Max Laboratories Inc. has been operating for over thirty years producing medications and food for pets and farm animals. Due to new growth opportunities they are interested in your expert opinion on a series of issues described below The firm has a target capital structure of 40 persen debt and 60 percent comme equity, which the CFO.comsiders to be the optimal capital structure and plans to maintain it in the future Next year the firm forecasts Faming per share (EPS) of S15, Me Lalls das One million common shares outstanding Now leather words, the fire Nedale 375.000000 315 * 1,000,000 bars - 315 MilliNed Income The firm us a line of credit at the local bank at the following interest rates Can borrow up to 56,000,000 at an interest rate the tale goes to 10 for amounts above 56.000.000 The firm interest by tax rate is 25 percent The firm plans to retain 20% of the forecasted Net Income, the remaining 10% of the estimated profits will be paid as dividends to common shareholders next year Note: Thir memaroor of 515.000.000 Net in $10.5 i go no Resid Barnings (515 willion X 70%) and the Declav Dhedende will be - 5450 milion 515 million X Currently common shares sell for $10 and the exported earnings growth is 95. The flotation costs to nese new comme equity capital, equal 7% of the share price C) Cost of new equity. 2. Calculate the two Marginal cost of capital break points. Show the amount of total capital and how much would be raised from Common Equity and Debt at each point A) Break point when the firm needs to borrow at the higher cost of debt but still does not need to issue new equity B) Break point when the firm needs to start issuing new equity (has exhausted the retained earnings). Notice that at this point the firm is already using the higher cost of det 3. Calculate the weighted average cost of capital at all the break points found on Ouestion 2 above. Show the three amounts of capital that triever each WACC

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts