Question: Section 2: Written and Practical Calculations (60 Marks) You are required to attempt 3 questions out of the given 4 questions below. Each question is

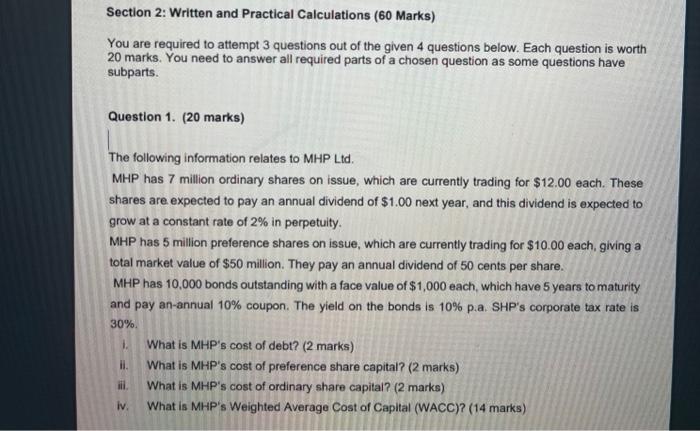

Section 2: Written and Practical Calculations (60 Marks) You are required to attempt 3 questions out of the given 4 questions below. Each question is worth 20 marks. You need to answer all required parts of a chosen question as some questions have subparts. Question 1. (20 marks) The following information relates to MHP Ltd. MHP has 7 million ordinary shares on issue, which are currently trading for $12.00 each. These shares are expected to pay an annual dividend of $1.00 next year, and this dividend is expected to grow at a constant rate of 2% in perpetuity. MHP has 5 million preference shares on issue, which are currently trading for $10.00 each, giving a total market value of $50 million. They pay an annual dividend of 50 cents per share. MHP has 10,000 bonds outstanding with a face value of $1,000 each, which have 5 years to maturity and pay an-annual 10% coupon. The yield on the bonds is 10% p.a. SHP's corporate tax rate is 30%. 1. What is MHP's cost of debt? (2 marks) Hi. What is MHP's cost of preference share capital? (2 marks) iii. What is MHP's cost of ordinary share capital? (2 marks) iv. What is MHP's Weighted Average Cost of Capital (WACC)? (14 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts