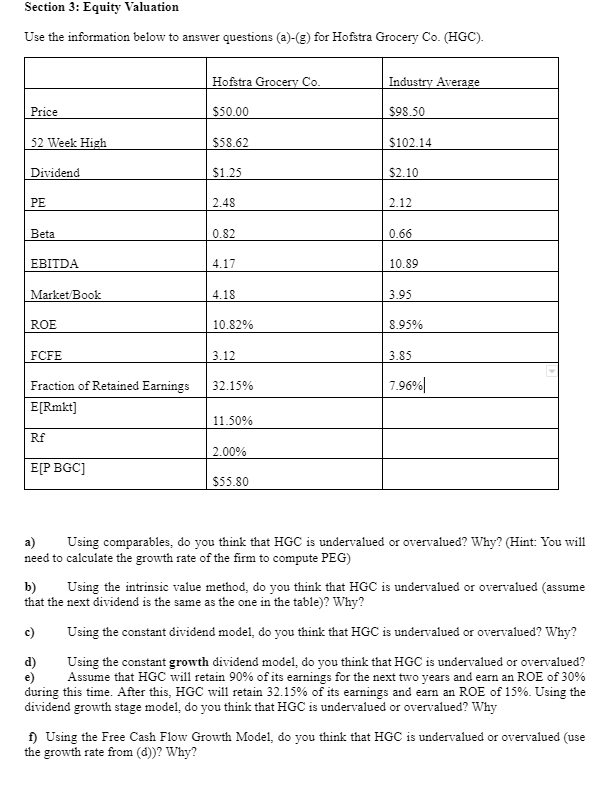

Question: Section 3: Equity Valuation Use the information below to answer questions (a)-(g) for Hofstra Grocery Co. (HGC). a) Using comparables, do you think that HGC

Section 3: Equity Valuation Use the information below to answer questions (a)-(g) for Hofstra Grocery Co. (HGC). a) Using comparables, do you think that HGC is undervalued or overvalued? Why? (Hint: You will need to calculate the growth rate of the firm to compute PEG ) b) Using the intrinsic value method, do you think that HGC is undervalued or overvalued (assume that the next dividend is the same as the one in the table)? Why? c) Using the constant dividend model, do you think that HGC is undervalued or overvalued? Why? d) Using the constant growth dividend model, do you think that HGC is undervalued or overvalued? e) Assume that HGC will retain 90% of its earnings for the next two years and earn an ROE of 30% during this time. After this, HGC will retain 32.15% of its earnings and earn an ROE of 15%. Using the dividend growth stage model, do you think that HGC is undervalued or overvalued? Why f) Using the Free Cash Flow Growth Model, do you think that HGC is undervalued or overvalued (use the growth rate from (d))? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts