Question: Section A 3. Create possible business transactions for the first month of the business accounting period. Clearly state the month of the business transactions.. The

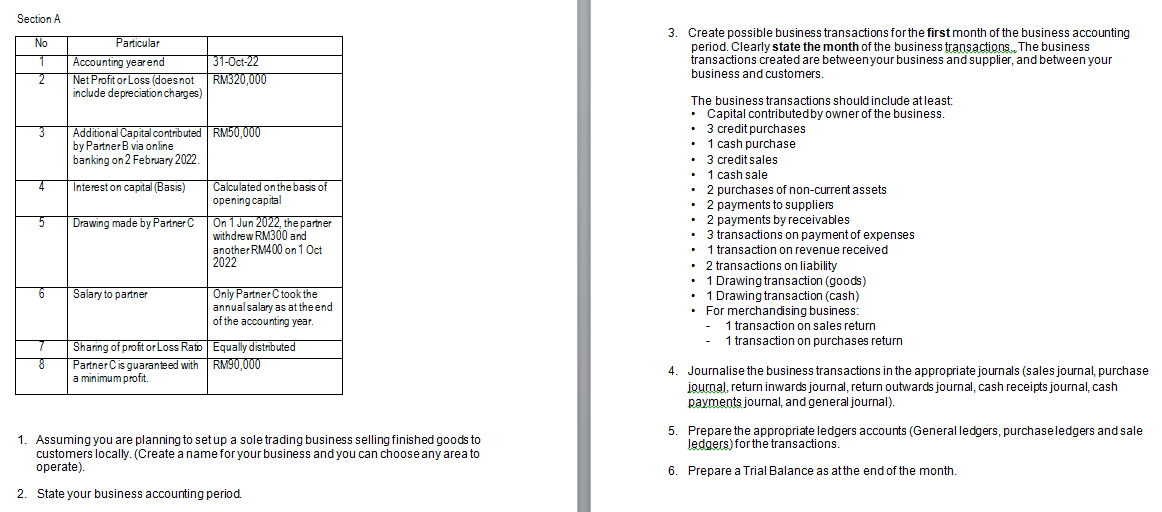

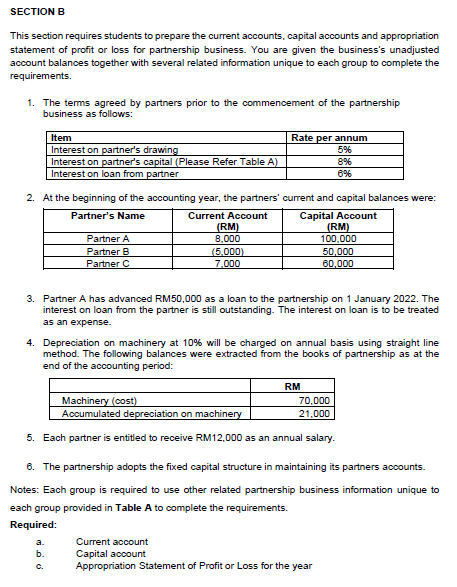

Section A 3. Create possible business transactions for the first month of the business accounting period. Clearly state the month of the business transactions.. The business transactions created are betweenyour business and supplier, and between your business and customers. The business transactions should include at least: - Capital contributed by owner of the business. - 3 credit purchases - 1 cash purchase - 3 creditsales - 1 cash sale - 2 purchases of non-current assets - 2 payments to suppliers - 2 payments by receivables - 3 transactions on payment of expenses - 1 transaction on revenue received - 2 transactions on liability - 1 Drawing transaction (goods) - 1 Drawing transaction (cash) - For merchandising business: - 1 transaction on sales return - 1 transaction on purchases return 1. Assuming you are planning to set up a sole trading business selling finished goods to customers locally. (Create a name for your business and you can choose any area to operate). 2. State your business accounting period. 4. Journalise the business transactions in the appropriate journals (sales journal, purchase journal, return inwards journal, return outwards journal, cash receipts journal, cash payments journal, and general journal). 5. Prepare the appropriate ledgers accounts (General ledgers, purchase ledgers and sale ledgers) for the transactions. 6. Prepare a Trial Balance as at the end of the month. SECTION B This section requires students to prepare the current accounts, capital accounts and appropriation statement of profit or loss for partnership business. You are given the business's unadjusted account balances together with several related information unique to each group to complete the requirements. 1. The terms agreed by partners prior to the commencement of the partnership business as follows: F 2. At the beginning of the accounting year, the partners' current and capital balances were: 3. Partner A has advanced RM50,000 as a loan to the partnership on 1 January 2022. The interest on loan from the partner is still outstanding. The interest on loan is to be treated as an expense. 4. Depreciation on machinery at 10% will be charged on annual basis using straight line method. The following balances were extracted from the books of partnership as at the end of the accounting period: 5. Each partner is entitled to receive RM12,000 as an annual salary. 6. The partnership adopts the fixed capital structure in maintaining its partners accounts. Notes: Each group is required to use other related partnership business information unique to each group provided in Table A to complete the requirements. Required: a. Current account b. Capital account c. Appropriation Statement of Profit or Loss for the year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts