Question: SECTION A Answer ALL question in Section A. QUESTION ONE You are investigating the systematic risk for a stock portfolio. The data contains weekly excess

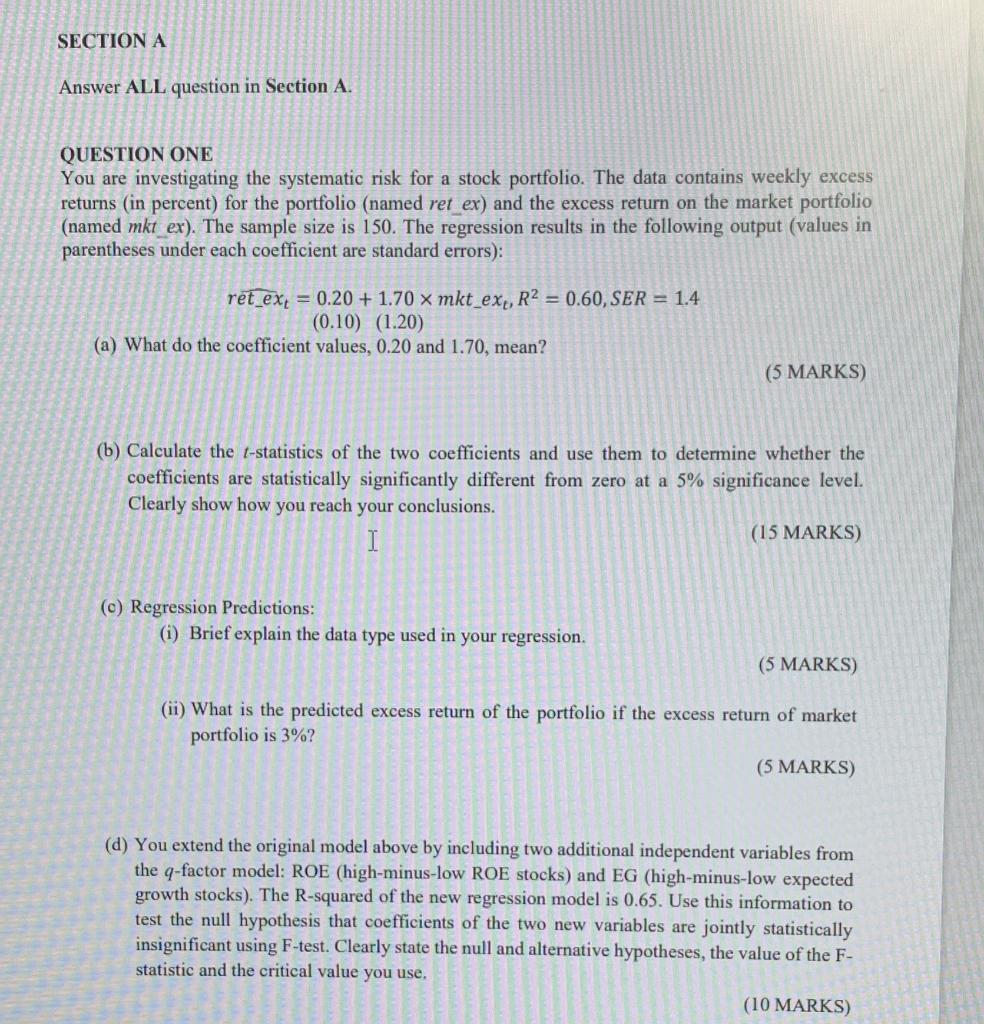

SECTION A Answer ALL question in Section A. QUESTION ONE You are investigating the systematic risk for a stock portfolio. The data contains weekly excess returns (in percent) for the portfolio (named ret_ex) and the excess return on the market portfolio (named mkt ex). The sample size is 150. The regression results in the following output (values in parentheses under each coefficient are standard errors): ret_ex=0.20+ 1.70 x mkt_ext, R = 0.60, SER = 1.4 (0.10) (1.20) (a) What do the coefficient values, 0.20 and 1.70, mean? (5 MARKS) (b) Calculate the t-statistics of the two coefficients and use them to determine whether the coefficients are statistically significantly different from zero at a 5% significance level. Clearly show how you reach your conclusions. (15 MARKS) I (c) Regression Predictions: (i) Brief explain the data type used in your regression. (5 MARKS) (ii) What is the predicted excess return of the portfolio if the excess return of market portfolio is 3%? (5 MARKS) (d) You extend the original model above by including two additional independent variables from the q-factor model: ROE (high-minus-low ROE stocks) and EG (high-minus-low expected growth stocks). The R-squared of the new regression model is 0.65. Use this information to test the null hypothesis that coefficients of the two new variables are jointly statistically insignificant using F-test. Clearly state the null and alternative hypotheses, the value of the F- statistic and the critical value you use. (10 MARKS) SECTION A Answer ALL question in Section A. QUESTION ONE You are investigating the systematic risk for a stock portfolio. The data contains weekly excess returns (in percent) for the portfolio (named ret_ex) and the excess return on the market portfolio (named mkt ex). The sample size is 150. The regression results in the following output (values in parentheses under each coefficient are standard errors): ret_ex=0.20+ 1.70 x mkt_ext, R = 0.60, SER = 1.4 (0.10) (1.20) (a) What do the coefficient values, 0.20 and 1.70, mean? (5 MARKS) (b) Calculate the t-statistics of the two coefficients and use them to determine whether the coefficients are statistically significantly different from zero at a 5% significance level. Clearly show how you reach your conclusions. (15 MARKS) I (c) Regression Predictions: (i) Brief explain the data type used in your regression. (5 MARKS) (ii) What is the predicted excess return of the portfolio if the excess return of market portfolio is 3%? (5 MARKS) (d) You extend the original model above by including two additional independent variables from the q-factor model: ROE (high-minus-low ROE stocks) and EG (high-minus-low expected growth stocks). The R-squared of the new regression model is 0.65. Use this information to test the null hypothesis that coefficients of the two new variables are jointly statistically insignificant using F-test. Clearly state the null and alternative hypotheses, the value of the F- statistic and the critical value you use. (10 MARKS)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts