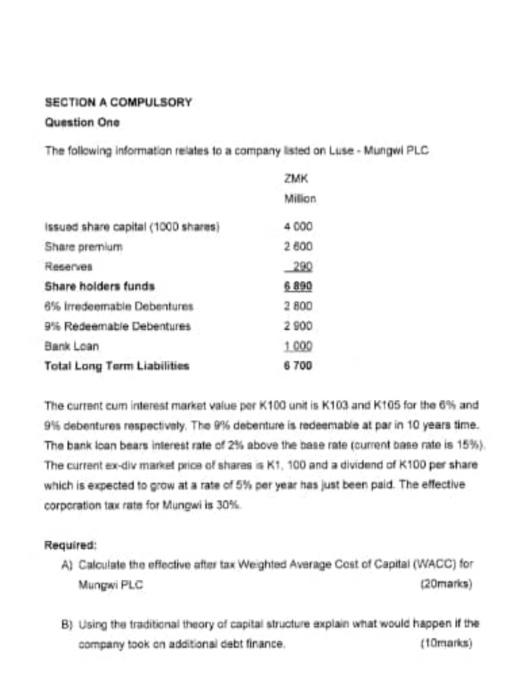

Question: SECTION A COMPULSORY Question One The following information relates to a company listed on Luse-Mungwi PLC ZMK Million issued share capital (1000 shares) Share

SECTION A COMPULSORY Question One The following information relates to a company listed on Luse-Mungwi PLC ZMK Million issued share capital (1000 shares) Share premium Reserves Share holders funds 6% Irredeemable Debentures 9% Redeemable Debentures Bank Loan Total Long Term Liabilities 4000 2600 290 6.890 2 800 2900 1.000 6 700 The current cum interest market value per K100 unit is K103 and K105 for the 6% and 9% debentures respectively. The 9% debenture is redeemable at par in 10 years time. The bank loan bears interest rate of 2% above the base rate (current base rate is 15%). The current ex-div market price of shares is K1, 100 and a dividend of K100 per share which is expected to grow at a rate of 5% per year has just been paid. The effective corporation tax rate for Mungwi is 30% Required: A) Calculate the effective after tax Weighted Average Cost of Capital (WACC) for Mungwi PLC (20marks) B) Using the traditional theory of capital structure explain what would happen if the company took on additional debt finance. (10marks)

Step by Step Solution

There are 3 Steps involved in it

A Weighted Average Cost of Capital WACC for Mungwi PLC Total Equity 3800 290 890 5080 Total Debt 290... View full answer

Get step-by-step solutions from verified subject matter experts